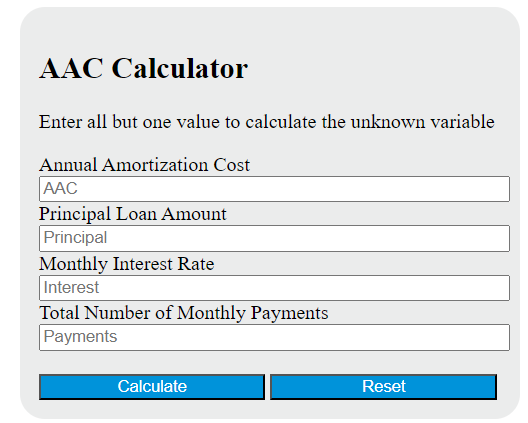

Enter the principal loan amount, monthly interest rate, and total number of monthly payments into the calculator to determine the annual amortization cost; this calculator can also evaluate any of the variables given the others are known.

Aac Formula

The following formula is used to calculate the Aac (Annual Amortization Cost) for a loan:

Aac = (P * r * (1 + r)^n) / ((1 + r)^n - 1)

Variables:

- Aac is the annual amortization cost

- P is the principal loan amount

- r is the monthly interest rate

- n is the total number of monthly payments

To calculate the Aac, multiply the principal loan amount by the monthly interest rate, then raise the result to the power of the total number of monthly payments. Add 1 to the monthly interest rate and raise it to the power of the total number of monthly payments. Divide the first result by the second result, and subtract 1 from the quotient. The resulting value is the annual amortization cost.

How to Calculate Aac?

The following steps outline how to calculate the Cost Recovery Ratio for a Aac:

- First, determine the fare revenue ($).

- Next, determine the operating costs ($).

- Next, gather the formula from above = CRR = FR / OC.

- Finally, calculate the Cost Recovery Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge:

Fare revenue ($) = 94

Operating costs ($) = 32