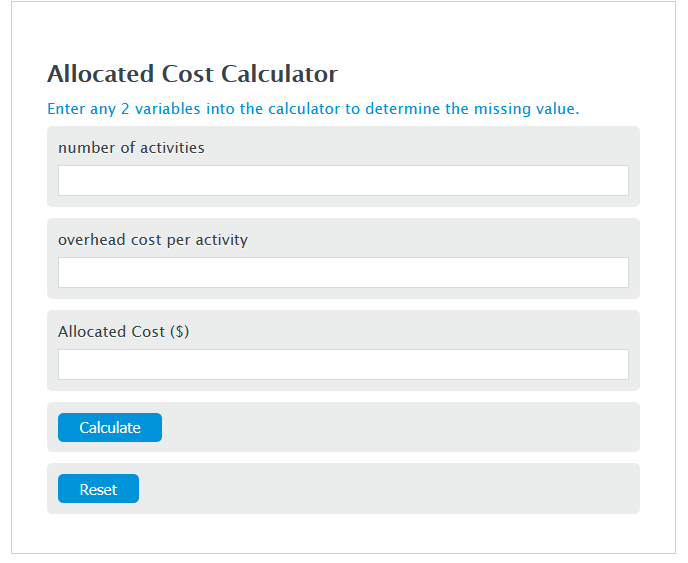

Enter the number of activities and the overhead cost per activity into the Calculator. The calculator will evaluate the Allocated Cost.

Allocated Cost Formula

ALC = NA * OCPA

Variables:

- ALC is the Allocated Cost ($)

- NA is the number of activities

- OCPA is the overhead cost per activity

To calculate the Allocated Cost, multiply the number of activities by the overhead cost per activity.

How to Calculate Allocated Cost?

The following steps outline how to calculate the Allocated Cost.

- First, determine the number of activities.

- Next, determine the overhead cost per activity.

- Next, gather the formula from above = ALC = NA * OCPA.

- Finally, calculate the Allocated Cost.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

number of activities = 5

overhead cost per activity = 100

FAQs

What is the significance of calculating Allocated Cost?

Calculating Allocated Cost helps businesses distribute overhead costs accurately across various activities or projects, ensuring that each activity bears its fair share of the overhead. This is crucial for pricing, budgeting, and financial analysis.

Can Allocated Cost vary from one period to another?

Yes, Allocated Cost can vary between periods due to changes in the number of activities or fluctuations in overhead costs. Regular recalculations are necessary to maintain accurate cost allocations.

How do overhead costs impact a company’s profitability?

Overhead costs, which include expenses like rent, utilities, and salaries, indirectly contribute to a company’s products or services. If not properly managed and allocated, these costs can significantly impact a company’s profitability by increasing the cost of goods sold and reducing the overall margin.

Is there a difference between Allocated Cost and Applied Overhead?

Yes, there is a difference. Allocated Cost refers to the distribution of overhead costs based on a specific formula or method, such as the number of activities. Applied Overhead, on the other hand, involves assigning estimated overhead costs to specific cost objects based on a predetermined rate. Both concepts are used in cost accounting to ensure accurate costing and financial analysis.