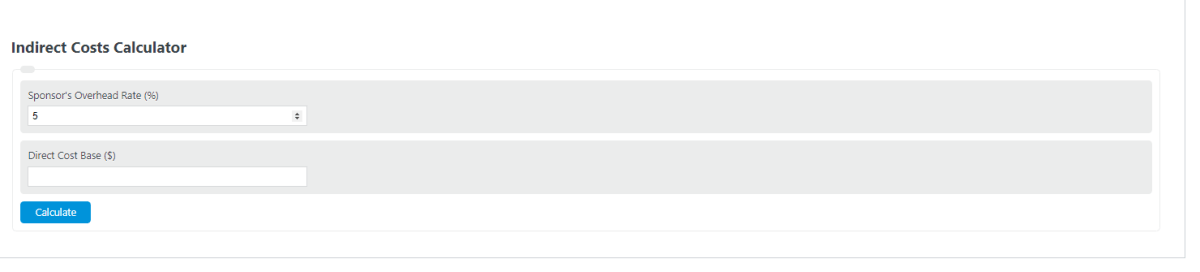

Enter the sponsor’s overhead rate and the direct costs into the calculator to determine the indirect costs.

- Budget Variance Calculator

- Economic Profit Calculator

- Direct Labor Costs Calculator

- Economic Impact Calculator

- Indirect Cost Rate Calculator

Indirect Costs Formula

The following formula is used to calculate the indirect costs of a budget preparation

IC = SOR/100 * DC

- Where IC is the indirect costs ($)

- SOR is the sponsors’ overhead rate (%)

- DC is the direct cost base ($)

To calculate the indirect costs, multiply the overhead rate by the direct cost.

Indirect Costs Definition

Indirect costs are defined as project-related costs that cannot easily be identified for a particular project. In other words, these are the overhead costs of a project.

How to calculate indirect costs?

Example Problem #1:

First, determine the sponsor’s overhead rate. In this example, the sponsor is charging an overhead rate of 50%.

Next, determine the direct cost base. The direct cost base of this planned project is budgeted to be $100,000.00.

Finally, calculate the indirect costs using the formula above:

IC = SOR/100 * DC

= 50/100 * $100,000.00

= $50,000.00.

Example Problem #2:

In this next example, the sponsor’s overhead rate is much higher, at 87% of direct costs.

The direct costs of this project are also higher at $200,000.00.

Using the formula as we did above, the indirect costs are calculated as :

IC = SOR/100 * DC

= 87/100*200,000

= $174,000.00.