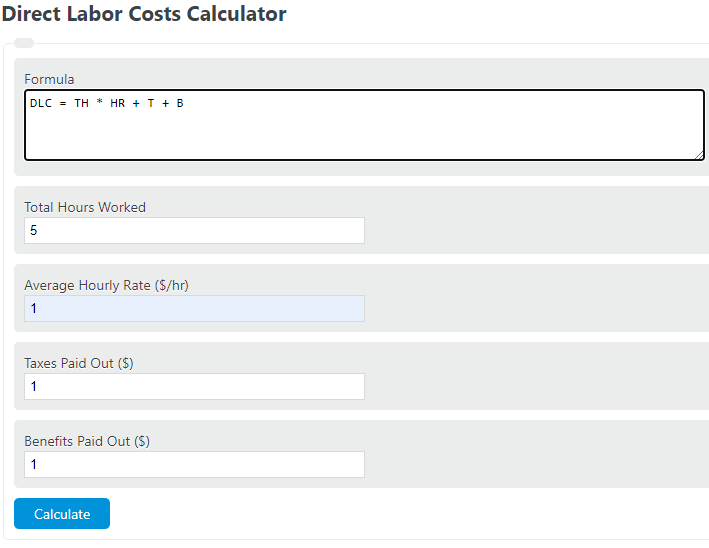

Enter the total hours worked, average hourly rate, taxes, and benefits paid to determine the direct labor costs.

- Labor Efficiency Variance Calculator

- Labor Rate Variance Calculator

- Marginal Product of Labor Calculator

- Labor Percentage Calculator

- Labor Utilization Calculator

Direct Labor Costs Formula

The following formula is used to calculate direct labor costs.

DLC = TH * HR + T + B

- Where DLC is the direct labor costs

- TH is the total hours worked

- HR is the hourly rate

- T is the taxes paid during the time period

- B are the benefits paid during the time period

To calculate direct labor costs, multiply the total hours worked by the hourly rate, then add the taxes and benefits paid during the period.

Direct Labor Costs Definition

Direct labor costs are defined as a cost of labor that goes directly into the production or manufacturing of a good. These include the wages, taxes, and benefits paid to the employees that directly worked on the product over a time period.

Direct Labor Costs Example

FAQ

How to calculate direct labor costs?

- First, determine the hours worked and rate.

Determine the total number of hours and hourly rate for those working on the good.

- Next, determine the taxes and benefits.

Calculate the taxes and benefits paid to the employees during the same time period. For example, if employees get $5,000.00 paid out over the year in taxes and benefits, and the workers spent one month working on the product, then the taxes and benefits would be 5000/12 = $416.66.

- Finally, calculate the direct labor costs.

Calculate the direct labor costs using the equation above.