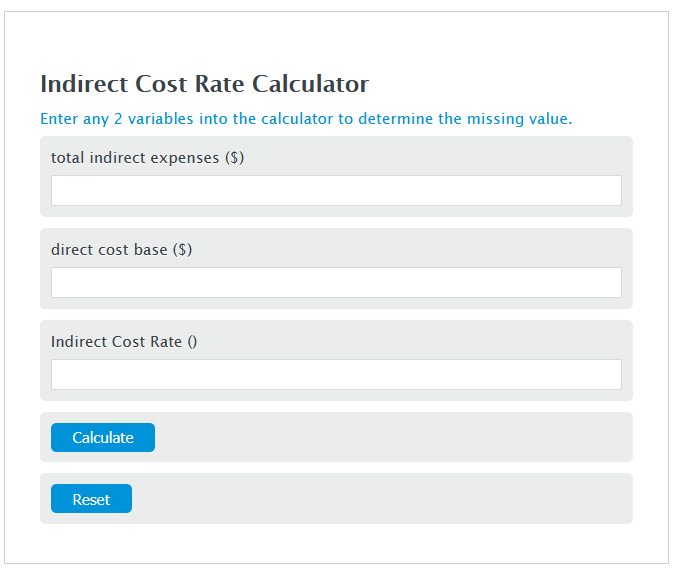

Enter the total indirect expenses ($) and the direct cost base ($) into the Calculator. The calculator will evaluate the Indirect Cost Rate.

Indirect Cost Rate Formula

ICR = TIE / DC

Variables:

- ICR is the Indirect Cost Rate ()

- TIE is the total indirect expenses ($)

- DC is the direct cost base ($)

To calculate Indirect Cost Rate, divide the total indirect expenses by the direct cost base.

How to Calculate Indirect Cost Rate?

The following steps outline how to calculate the Indirect Cost Rate.

- First, determine the total indirect expenses ($).

- Next, determine the direct cost base ($).

- Next, gather the formula from above = ICR = TIE / DC.

- Finally, calculate the Indirect Cost Rate.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total indirect expenses ($) = 400

direct cost base ($) = 100

Frequently Asked Questions

What are indirect costs?

Indirect costs are expenses that are not directly tied to a specific project, product, or service but are necessary for the general operation of a business. These can include rent, utilities, administrative salaries, and security services.

How does the Indirect Cost Rate impact budgeting and pricing?

The Indirect Cost Rate is crucial for accurately budgeting and pricing as it helps in allocating the indirect costs to various projects or products. Understanding this rate enables businesses to set prices that cover all costs, ensuring profitability.

Can the Indirect Cost Rate vary between industries?

Yes, the Indirect Cost Rate can significantly vary between industries due to differences in the nature of their operations, the scale of projects, and the types of indirect costs incurred. Industries with higher overhead costs may have a higher Indirect Cost Rate.

Why is it important to calculate the Indirect Cost Rate accurately?

Accurately calculating the Indirect Cost Rate is essential for effective financial management. It ensures that indirect costs are properly accounted for, which is crucial for pricing, budgeting, and financial analysis. An accurate rate helps in making informed decisions and maintaining profitability.