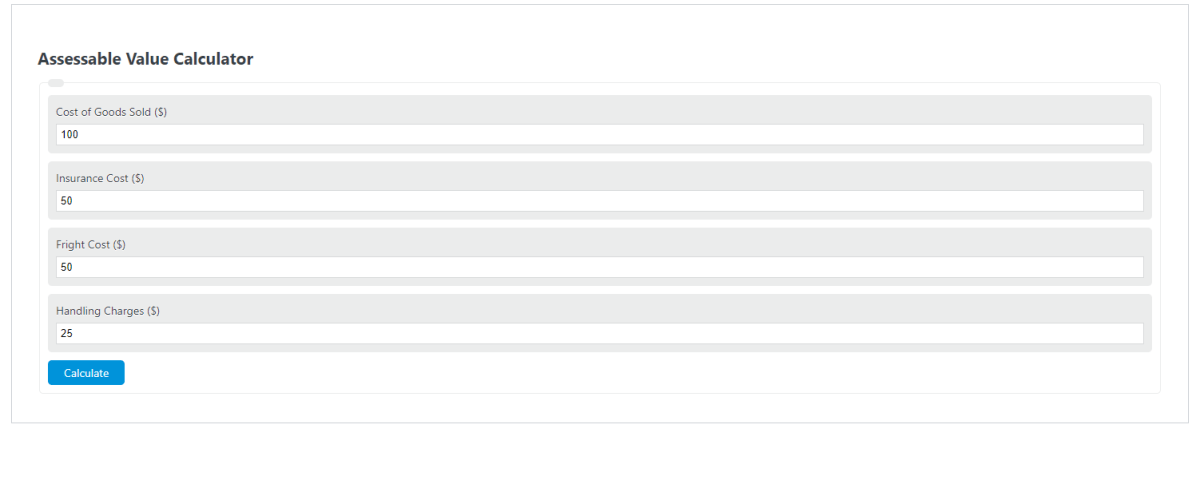

Enter the cost of goods sold, cost of insurance, cost of freight, and handling charges into the calculator to determine the assessable value.

- Cost of Goods Purchased Calculator

- Unadjusted Cost of Goods Sold Calculator

- Accounting Profit Calculator

- Car Insurance Cost Per Month Calculator

- Sales To Market Value Ratio Calculator

Assessable Value Formula

The following equation is used to calculate the Assessable Value.

AV = COGS + I + F + H

- Where AV is the assessable value ($)

- COGS is the cost of goods sold ($)

- I is the cost of insurance ($)

- F is the freight cost ($)

- H is any handling charges ($)

To calculate the assessable value, sum together the cost of goods sold, cost of insurance, handling charges, and freight cost together.

What is an Assessable Value?

Definition:

Assessable value is a term used in Customs to describe the value of imported goods. Assessable value is different than the actual value of the goods, which is often lower. The assessable value is based on different methods of valuation.

An example of this are automobiles that are imported into Canada from the United States. Automobiles have a specific tariff rate that applies to them and this rate is calculated by using the vehicle’s country of origin and its type (passenger car or truck).

Logistics Import Export or freight forwarding process involves a number of customs procedures and requirements. The amount of import duty, tax or levy that must be paid on goods being imported into the country or being exported from the country is called assessable value.