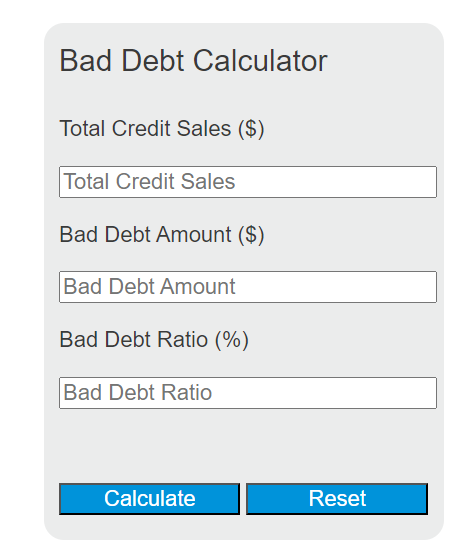

Enter the total credit sales and the bad debt amount into the calculator to determine the bad debt ratio. This ratio helps businesses understand the percentage of credit sales that have not been collected and are considered non-recoverable.

Bad Debt Ratio Formula

The following formula is used to calculate the bad debt ratio:

BDR = (BDA / TCS) * 100

Variables:

- BDR is the bad debt ratio (%)

- BDA is the bad debt amount ($)

- TCS is the total credit sales ($)

To calculate the bad debt ratio, divide the bad debt amount by the total credit sales and then multiply by 100 to get the percentage.

What is a Bad Debt Ratio?

The bad debt ratio is a financial metric that indicates the percentage of credit sales that are expected to be uncollectible. This ratio is important for businesses to estimate the amount of sales that will not result in cash flow due to non-payment. A higher bad debt ratio suggests a greater amount of sales at risk, which can impact a company’s profitability and liquidity.

How to Calculate Bad Debt Ratio?

The following steps outline how to calculate the Bad Debt Ratio.

- First, determine the total credit sales (TCS) in dollars.

- Next, determine the bad debt amount (BDA) in dollars.

- Next, gather the formula from above = BDR = (BDA / TCS) * 100.

- Finally, calculate the Bad Debt Ratio (BDR) in percentage.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Total credit sales (TCS) = $50,000

Bad debt amount (BDA) = $2,500