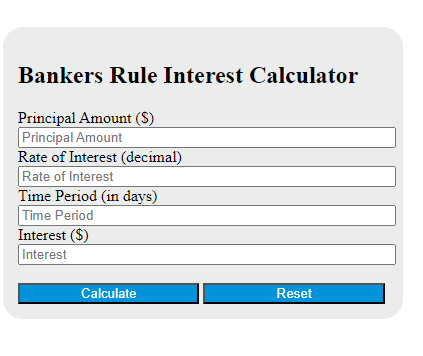

Enter the principal amount, rate of interest, and time period into the calculator to determine the Bankers Rule Interest.

Bankers Rule Interest Formula

The following formula is used to calculate the Bankers Rule Interest.

I = (P * r * t) / 360

Variables:

- I is the interest ($)

- P is the principal amount ($)

- r is the rate of interest (decimal)

- t is the time period (in days)

To calculate the Bankers Rule Interest, multiply the principal amount by the rate of interest, and then by the time period. Divide the result by 360.

What is a Bankers Rule Interest?

Bankers Rule Interest, also known as the Ordinary Interest Method, is a method of calculating interest based on a 360-day year instead of a 365-day year. This method is often used by banks and other financial institutions for its simplicity and convenience. The interest is calculated by multiplying the principal amount by the rate of interest and the time period, which is then divided by 360. This method can result in slightly higher interest charges compared to the Exact Interest Method which uses a 365-day year.

How to Calculate Bankers Rule Interest?

The following steps outline how to calculate the Bankers Rule Interest using the given formula:

- First, determine the principal amount ($), denoted as P.

- Next, determine the rate of interest (decimal), denoted as r.

- Next, determine the time period in days, denoted as t.

- Next, use the formula: I = (P * r * t) / 360 to calculate the interest ($).

- Finally, calculate the Bankers Rule Interest.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge:

Principal amount ($), P = 5000

Rate of interest (decimal), r = 0.05

Time period in days, t = 180