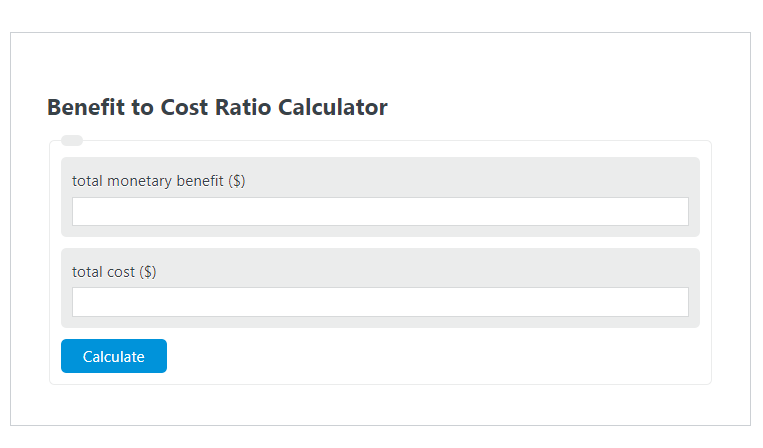

Enter the total monetary benefit ($) and the total cost ($) into the Benefit to Cost Ratio Calculator. The calculator will evaluate and display the Benefit to Cost Ratio.

- All Ratio Calculators

- Cost Benefit Analysis Calculator

- Leverage Ratio Calculator

- Debt Service Coverage Ratio Calculator

Benefit to Cost Ratio Formula

The following formula is used to calculate the Benefit to Cost Ratio.

BCR = MB / TC

- Where BCR is the Benefit to Cost Ratio ( )

- MB is the total monetary benefit ($)

- TC is the total cost ($)

To calculate the benefit-to-cost ratio, divide the total monetary benefit by the total cost.

How to Calculate Benefit to Cost Ratio?

The following example problems outline how to calculate Benefit to Cost Ratio.

Example Problem #1:

- First, determine the total monetary benefit ($).

- The total monetary benefit ($) is given as: 1500.

- Next, determine the total cost ($).

- The total cost ($) is provided as: 400.

- Finally, calculate the Benefit to Cost Ratio using the equation above:

BCR = MB / TC

The values given above are inserted into the equation below and the solution is calculated:

BCR = 1500 / 400 = 3.75 ( )

FAQ

What is the significance of a high Benefit to Cost Ratio (BCR)?

A high Benefit to Cost Ratio indicates that the benefits of a project or investment significantly outweigh its costs, making it a potentially profitable and viable option. It suggests that for every dollar spent, the return or benefit is higher, which is a desirable outcome in financial and economic analysis.

Can the Benefit to Cost Ratio be used for all types of projects?

While the Benefit to Cost Ratio is a valuable tool in evaluating the financial feasibility of projects, it is more suitable for projects where both benefits and costs can be quantified in monetary terms. It may not be as effective for projects with intangible or non-monetary benefits and costs, such as environmental or social projects, without additional qualitative analysis.

How does the Benefit to Cost Ratio differ from ROI (Return on Investment)?

The Benefit to Cost Ratio and Return on Investment (ROI) both measure the profitability of investments, but they do so in different ways. BCR compares the total monetary benefits to the total costs, providing a ratio, while ROI measures the percentage return on the invested amount. BCR is often used in cost-benefit analysis for public projects, whereas ROI is commonly used in the private sector to evaluate the profitability of investments.