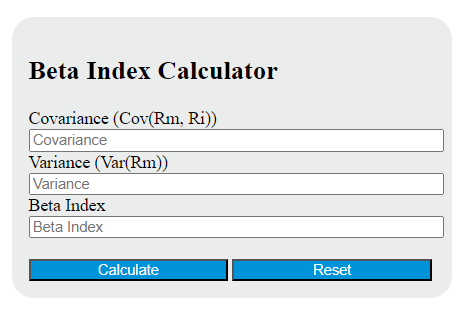

Enter the covariance between the return of the market and the return of the individual security, and the variance of the return of the market into the calculator to determine the Beta Index. This calculator can also evaluate any of the variables given the others are known.

Beta Index Formula

The following formula is used to calculate the Beta Index.

Beta = Cov(Rm, Ri) / Var(Rm)

Variables:

- Beta is the Beta Index

- Cov(Rm, Ri) is the covariance between the return of the market and the return of the individual security

- Var(Rm) is the variance of the return of the market

To calculate the Beta Index, first calculate the covariance between the return of the market and the return of the individual security. Then, calculate the variance of the return of the market. Finally, divide the covariance by the variance to get the Beta Index.

What is a Beta Index?

A Beta Index, or simply Beta, is a measure used in finance to determine the volatility or systematic risk of a security or portfolio in comparison to the market as a whole. It is used in the capital asset pricing model (CAPM), which calculates the expected return of an asset based on its beta and expected market returns. A beta of 1 indicates that the security’s price moves with the market, a beta less than 1 means it is less volatile than the market, while a beta greater than 1 indicates it is more volatile than the market.

How to Calculate Beta Index?

The following steps outline how to calculate the Beta Index.

- First, determine the covariance between the return of the market and the return of the individual security (Cov(Rm, Ri)).

- Next, determine the variance of the return of the market (Var(Rm)).

- Next, gather the formula from above = Beta = Cov(Rm, Ri) / Var(Rm).

- Finally, calculate the Beta Index.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Cov(Rm, Ri) = 0.75

Var(Rm) = 0.5