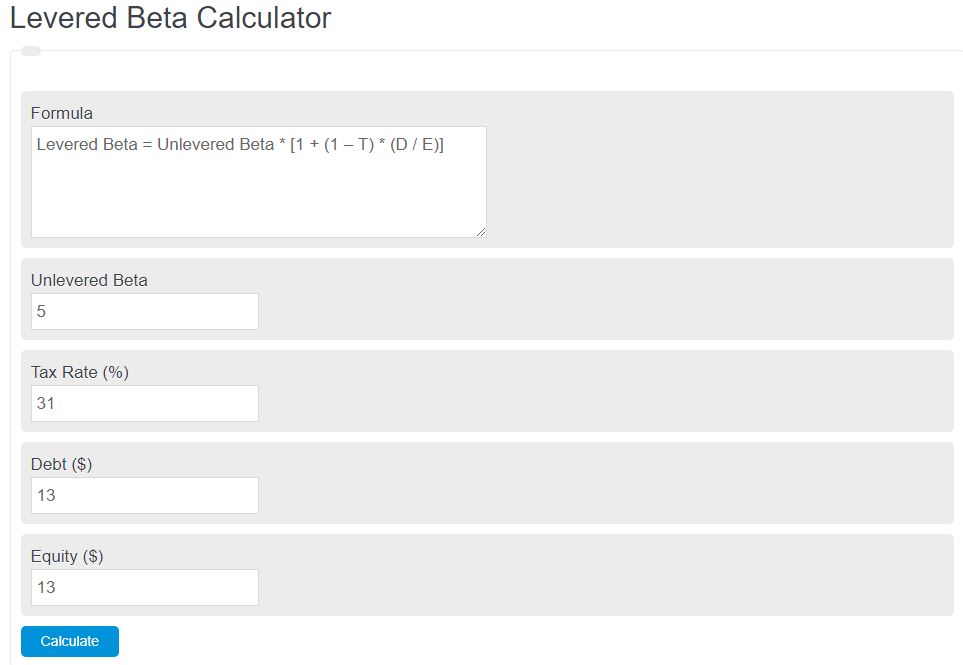

Enter the total unlevered beta, tax rate, debt, and equity into the calculator. The calculator will evaluate and display the levered beta.

- Debt to Equity Ratio Calculator

- Equity Value Calculator

- Equity Multiplier Calculator

- Unlevered Beta Calculator

Levered Beta Formula

The following equation is used to calculate a levered beta.

Levered Beta = UB * [1 + (1 – T) * (D / E)]

- Where T is the tax rate (%)

- UB is the unlevered beta

- D is the total debt

- E is the total equity

Levered Beta Definition

Levered beta is a measure of a risk of a companies stock when analyzing the rate of return of a stock using CAPM. It takes into account the companies debt to equity ratio in order to come up with a risk factor that can be used as an investing metric.

Levered Beta Example

How to calculate levered beta?

- First, determine the tax rate.

Determine the effective tax percentage.

- Next, determine the total debt.

Calculate the total debt.

- Next, determine the total equity.

Calculate the total equity.

- Finally, calculate the levered beta.

Calculate the levered beta using the formula above.

FAQ

Levered beta is a measure of the risk of a stock or business based on their tax rate, total debt, and total equity.