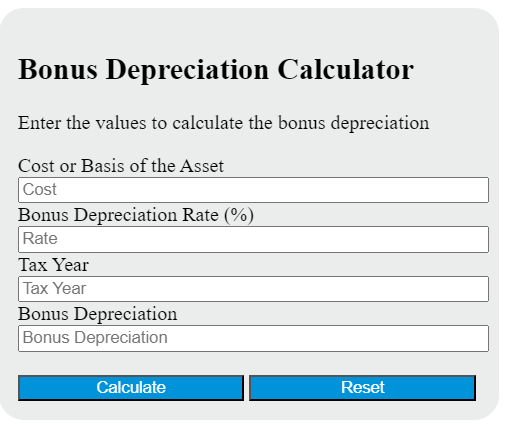

Enter the cost or basis of the asset, the bonus depreciation rate, and the tax year into the calculator to determine the bonus depreciation; this calculator can also evaluate any of the variables given the others are known.

Bonus Depreciation Formula

The following formula is used to calculate the bonus depreciation for an asset:

BD = (C * R * T) / 100

Variables:

- BD is the bonus depreciation

- C is the cost or basis of the asset

- R is the bonus depreciation rate

- T is the tax year

To calculate the bonus depreciation, multiply the cost or basis of the asset by the bonus depreciation rate and the tax year, then divide the result by 100.

What is a Bonus Depreciation?

Bonus depreciation is a tax incentive that allows a business to immediately deduct a large percentage of the purchase price of eligible business assets, rather than write them off over the “useful life” of that asset. This type of incentive is used to encourage businesses to buy new equipment, invest in their business and stimulate economic growth. The Tax Cuts and Jobs Act of 2017 increased the bonus depreciation deduction from 50% to 100% for qualified property acquired and placed in service after September 27, 2017, and before January 1, 2023. This means that businesses can write off the entire cost of most depreciable business assets in the year they are placed in service. The asset must be new, not used, and placed in service within the same tax year that the deduction is being claimed.

How to Calculate Bonus Depreciation?

The following steps outline how to calculate the Bonus Depreciation.

- First, determine the cost of the asset ($).

- Next, determine the bonus depreciation rate (%).

- Next, calculate the bonus depreciation amount by multiplying the cost of the asset by the bonus depreciation rate.

- Finally, subtract the bonus depreciation amount from the cost of the asset to get the adjusted basis.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Cost of the asset ($) = 10,000

Bonus depreciation rate (%) = 50