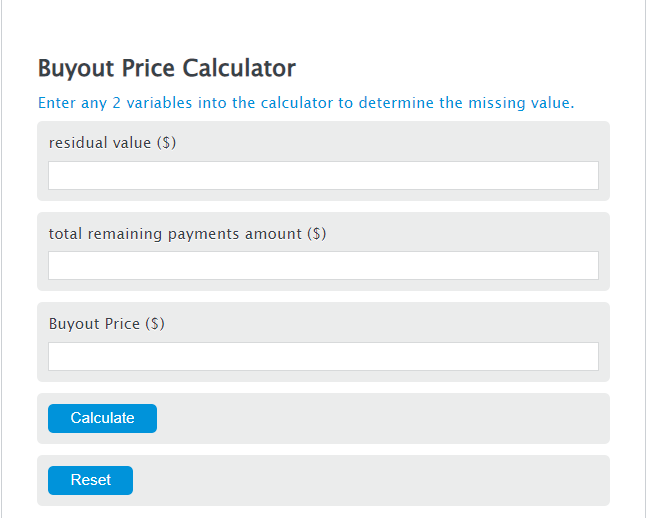

Enter the residual value ($) and the total remaining payments amount ($) into the Calculator. The calculator will evaluate the Buyout Price.

Buyout Price Formula

BP = RV + RP

Variables:

- BP is the Buyout Price ($)

- RV is the residual value ($)

- RP is the total remaining payments amount ($)

To calculate Buyout Price, sum the residual value and the total value of the remaining payments together.

How to Calculate Buyout Price?

The following steps outline how to calculate the Buyout Price.

- First, determine the residual value ($).

- Next, determine the total remaining payments amount ($).

- Next, gather the formula from above = BP = RV + RP.

- Finally, calculate the Buyout Price.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

residual value ($) = 10000

total remaining payments amount ($) = 3000

FAQs

What is Residual Value?

Residual Value is the estimated value of an asset at the end of its lease term or useful life. In the context of leasing, it's what the asset is expected to be worth by the time the lease expires.

How does the Buyout Price differ from the Salvage Value?

The Buyout Price is the cost to purchase an asset at the end of a lease, typically calculated by adding the residual value and any remaining payments. Salvage Value, on the other hand, is the estimated value of an asset at the end of its useful life, assuming it cannot be used for its intended purpose anymore but can still be sold for parts or scrap.

Why is calculating the Buyout Price important?

Calculating the Buyout Price is important for lessees to understand how much they would need to pay to purchase the leased asset at the end of the lease term. It helps in making informed financial decisions regarding the lease buyout.

Can the Buyout Price change over the course of a lease?

Yes, the Buyout Price can change over the course of a lease, especially if the residual value of the asset changes due to factors like market conditions, excessive wear and tear, or higher-than-expected mileage on a leased vehicle.