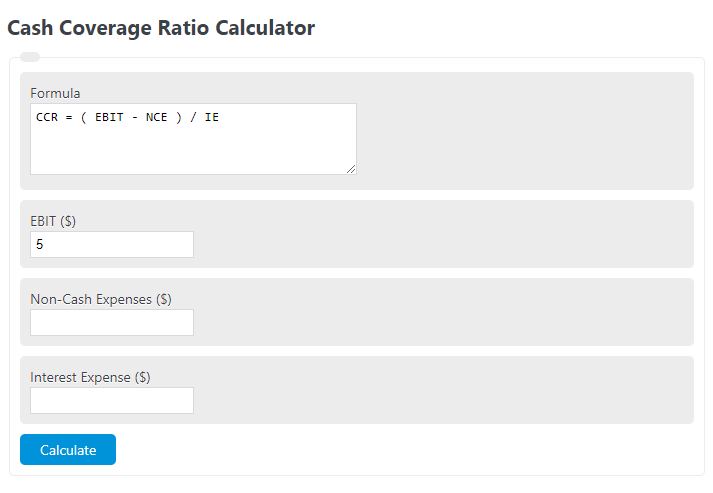

Enter the EBIT, non-cash expenses, and interest expenses into the calculator to determine the cash coverage ratio.

- Cash Ratio Calculator

- Accounts Receivable Turnover Ratio Calculator

- Actual Cash Value Calculator

- Interest Coverage Ratio Calculator

Cash Coverage Ratio Formula

The following formula is used to calculate the cash coverage ratio.

CCR = ( EBIT + NCE ) / IE

- Where CCR is the cash coverage ratio

- EBIT is the earnings before tax and interest

- NCE is the non-cash expenses

- IE is the interest expense

Interest expense refers to the cost incurred by a company or individual for borrowing funds or using credit, which is paid as interest to the lender.

Non-cash expenses refer to costs incurred by a business that do not involve an actual cash outflow, such as depreciation or amortization.

Earnings before tax and interest (EBTI) refers to a company’s income before deducting taxes and interest expenses.

Cash Coverage Ratio Definition

The Cash Coverage Ratio is a financial metric used to assess a company’s ability to cover its interest expenses with its available cash flow. It provides insight into a company’s ability to meet its debt obligations and indicates whether it has sufficient cash flow to pay interest on its outstanding debt. This ratio is particularly important for lenders and investors as it helps them evaluate the company’s financial health and risk level.

To calculate the Cash Coverage Ratio, one needs to divide a company’s operating cash flow by its total interest expenses. Operating cash flow represents the cash generated from core business operations, while interest expenses include the costs of servicing debt, such as loan interest payments. The resulting ratio indicates the number of times a company’s operating cash flow can cover its interest expenses.

A Cash Coverage Ratio above 1 indicates that a company generates enough cash flow to cover its interest payments, which is considered a positive sign. A ratio below 1 suggests that the company may struggle to meet its interest obligations, potentially indicating financial distress. For example, a ratio of 0.5 means that a company’s cash flow covers only half of its interest expenses.

Lenders and investors typically prefer higher Cash Coverage Ratios, as they indicate a greater ability to service debt and reduce the risk of default. However, it is essential to consider industry norms and compare the ratio with competitors to gain a more comprehensive understanding of the company’s financial position.

Cash Coverage Ratio Example

How to calculate the cash coverage ratio?

- First, determine the EBIT.

Calculate the earnings before interest and tax.

- Next, determine the non-cash expenses.

Measure the total non-cash expenses.

- Next, determine the interest expense.

Calculate the total interest expense.

- Finally, calculate the cash coverage ratio.

Calculate the cash coverage ratio using the equation above.