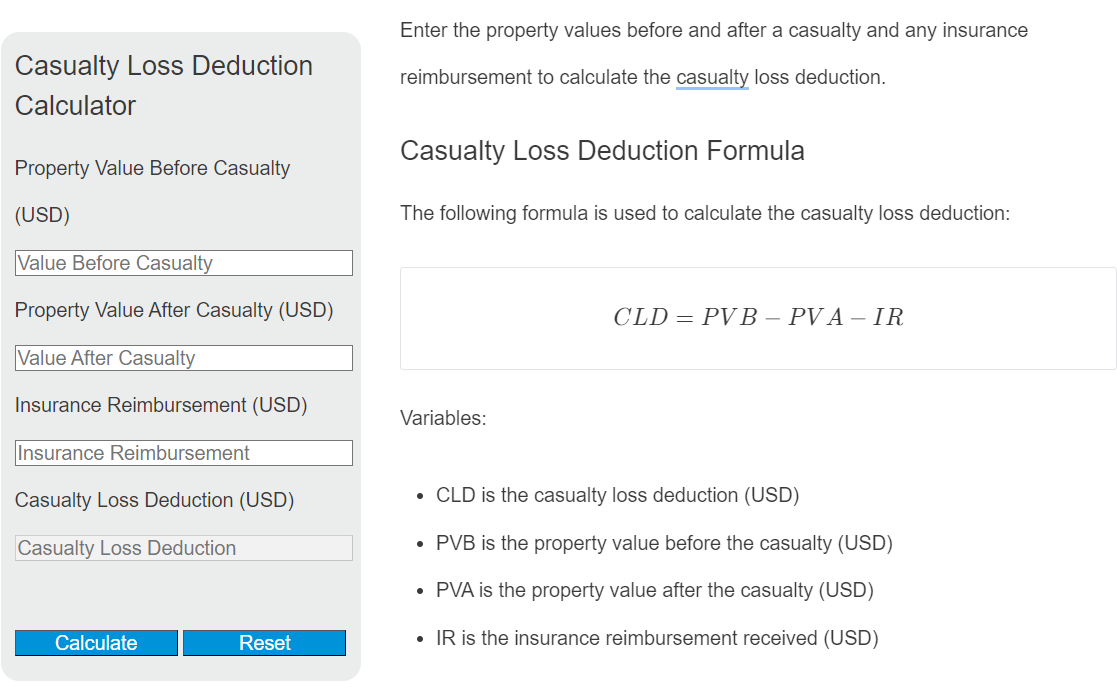

Enter the property values before and after a casualty and any insurance reimbursement to calculate the casualty loss deduction.

Casualty Loss Deduction Formula

The following formula is used to calculate the casualty loss deduction:

CLD = PVB - PVA - IR

Variables:

- CLD is the casualty loss deduction (USD)

- PVB is the property value before the casualty (USD)

- PVA is the property value after the casualty (USD)

- IR is the insurance reimbursement received (USD)

To calculate the casualty loss deduction, subtract the property value after the casualty and any insurance reimbursement from the property value before the casualty.

What is a Casualty Loss Deduction?

A casualty loss deduction is a tax deduction that allows taxpayers to deduct losses from their taxable income that result from sudden, unexpected, or unusual events. Such events can include natural disasters like hurricanes, floods, and earthquakes, as well as accidents and acts of vandalism. The deduction is calculated based on the decrease in property value as a result of the casualty, minus any insurance or other reimbursements received.

How to Calculate Casualty Loss Deduction?

The following steps outline how to calculate the Casualty Loss Deduction:

- Determine the property value before the casualty (PVB).

- Determine the property value after the casualty (PVA).

- Subtract any insurance reimbursement received (IR).

- Use the formula CLD = PVB – PVA – IR to calculate the Casualty Loss Deduction (CLD).

- Enter the values into the calculator above to verify your result.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Property value before the casualty (PVB) = $250,000

Property value after the casualty (PVA) = $150,000

Insurance reimbursement received (IR) = $20,000