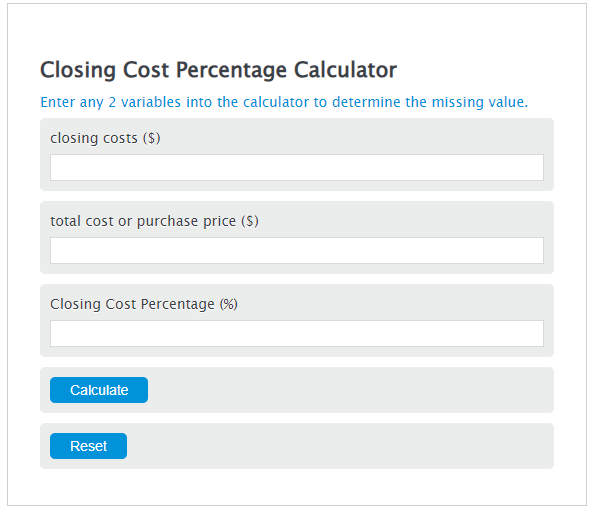

Enter the closing costs ($) and the total cost ($) into the Calculator. The calculator will evaluate the Closing Cost Percentage.

Closing Cost Percentage Formula

CCP = CC / TC * 100

Variables:

- CCP is the Closing Cost Percentage (%)

- CC is the closing costs ($)

- TC is the total cost or purchase price ($)

To calculate the Closing Cost Percentage, divide the total closing costs by the purchase price, then multiply by 100.

How to Calculate Closing Cost Percentage?

The following steps outline how to calculate the Closing Cost Percentage.

- First, determine the closing costs ($).

- Next, determine the total cost ($).

- Next, gather the formula from above = CCP = CC / TC * 100.

- Finally, calculate the Closing Cost Percentage.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

closing costs ($) = 10000

total cost ($) = 500000

FAQ

What are closing costs in real estate transactions?

Closing costs are fees and expenses you pay when you close on your house, beyond the down payment. These costs can include lender fees, title insurance, appraisal fees, and more.

Why is the Closing Cost Percentage important for buyers?

The Closing Cost Percentage gives buyers an idea of how much they will need to pay in addition to the purchase price of the home. It helps in budgeting and preparing for the additional costs involved in buying a property.

Can closing costs be negotiated or reduced?

Yes, some closing costs can be negotiated or reduced. Buyers can ask sellers to contribute towards closing costs, or shop around for cheaper services like home inspections or title searches.

How does the Closing Cost Percentage vary by location?

The Closing Cost Percentage can vary significantly by location due to differences in local tax laws, the cost of living, and competitive rates for services like lending and insurance. It’s important for buyers to research and understand the typical closing costs in their area.