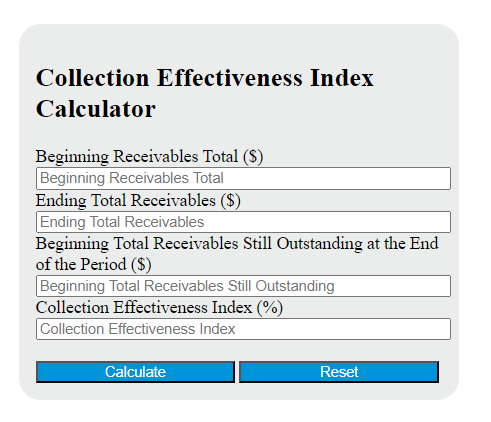

Enter the beginning receivables total, ending total receivables, and beginning total receivables still outstanding at the end of the period into the calculator to determine the Collection Effectiveness Index.

Collection Effectiveness Index Formula

The following formula is used to calculate the Collection Effectiveness Index (CEI).

CEI = [(B0 - BE) / (B0 - BS)] * 100

Variables:

- CEI is the Collection Effectiveness Index (%)

- B0 is the beginning receivables total ($)

- BE is the ending total receivables ($)

- BS is the beginning total receivables still outstanding at the end of the period ($)

To calculate the Collection Effectiveness Index, subtract the ending total receivables from the beginning receivables total. Then, subtract the beginning total receivables still outstanding at the end of the period from the beginning receivables total. Divide the first result by the second result, and multiply the quotient by 100 to get the Collection Effectiveness Index in percentage.

What is a Collection Effectiveness Index?

The Collection Effectiveness Index (CEI) is a financial metric used by businesses to measure the effectiveness of their accounts receivable collection efforts over a specific period. It compares the amount of money collected from customers to the amount of money that was owed at the beginning of the period, plus any additional credit sales. A higher CEI indicates a more effective collection process, while a lower CEI suggests inefficiencies in collecting receivables.

How to Calculate Collection Effectiveness Index?

The following steps outline how to calculate the Collection Effectiveness Index (CEI).

- First, determine the beginning receivables total (B0) ($).

- Next, determine the ending total receivables (BE) ($).

- Next, determine the beginning total receivables still outstanding at the end of the period (BS) ($).

- Next, use the formula CEI = [(B0 – BE) / (B0 – BS)] * 100 to calculate the Collection Effectiveness Index.

- Finally, calculate the CEI by inserting the variables and calculating the result.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Beginning receivables total (B0) ($) = 500

Ending total receivables (BE) ($) = 400

Beginning total receivables still outstanding at the end of the period (BS) ($) = 100