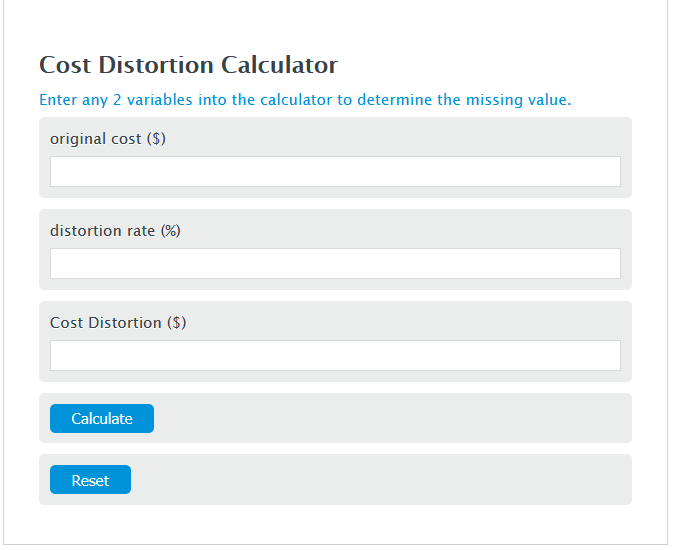

Enter the original cost ($) and the distortion rate (%) into the Calculator. The calculator will evaluate the Cost Distortion.

Cost Distortion Formula

CDIS = OC - OC * C/100

Variables:

- CDIS is the Cost Distortion ($)

- OC is the original cost ($)

- C is the distortion rate (%)

To calculate the Cost Distortion, multiply the original cost by the distortion rate, then subtract the result from the original cost.

How to Calculate Cost Distortion?

The following steps outline how to calculate the Cost Distortion.

- First, determine the original cost ($).

- Next, determine the distortion rate (%).

- Next, gather the formula from above = CDIS = OC – OC * C/100.

- Finally, calculate the Cost Distortion.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

original cost ($) = 5000

distortion rate (%) = 5

FAQ

What is cost distortion?

Cost distortion occurs when the actual cost of a product or service is misrepresented or inaccurately allocated. This can happen due to various factors, including incorrect application of overheads, misestimating the distortion rate, or applying an incorrect formula. It leads to a discrepancy between the reported cost and the actual cost.

Why is it important to calculate cost distortion accurately?

Accurately calculating cost distortion is crucial for businesses to understand the true cost of their products or services. This knowledge helps in setting the right price, making informed financial decisions, and improving profitability. It also aids in budgeting and financial planning, ensuring resources are allocated efficiently.

Can cost distortion affect financial statements?

Yes, cost distortion can significantly affect financial statements. If the cost of goods sold (COGS) or services is inaccurately reported, it can lead to misstated gross profit and net income. This misrepresentation can affect the decision-making of investors, creditors, and management, potentially leading to financial losses or misguided strategies.

How can businesses minimize cost distortion?

Businesses can minimize cost distortion by implementing accurate costing methods, regularly reviewing their cost allocation processes, and using advanced accounting software for precise calculations. Training staff on the importance of accurate cost measurement and regularly auditing financial reports can also help in minimizing discrepancies.