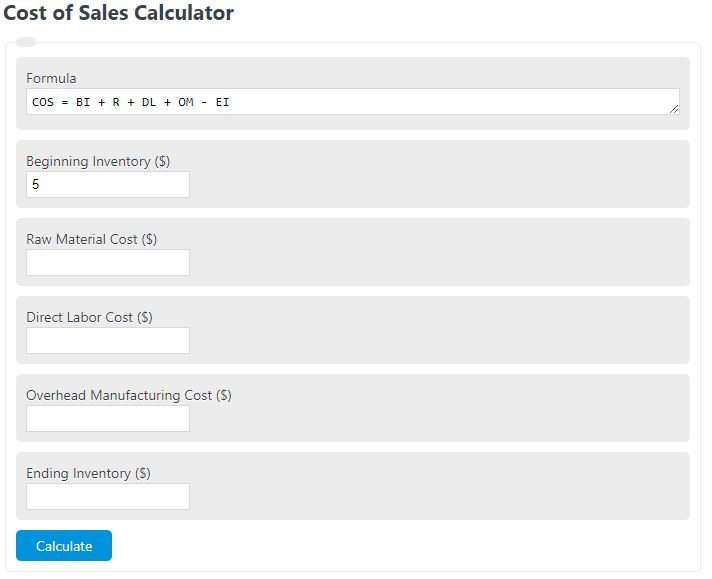

Enter the beginning inventory, raw material cost, cost of direct labor, overhead manufacturing cost, and ending inventory to determine the cost of sales.

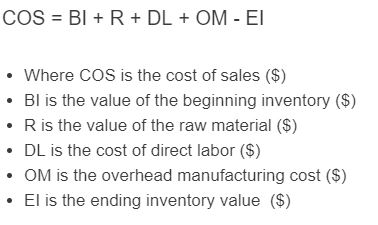

Cost of Sales Formula

The following formula is used to calculate the cost of sales.

COS = BI + R + DL + OM - EI

- Where COS is the cost of sales ($)

- BI is the value of the beginning inventory ($)

- R is the value of the raw material ($)

- DL is the cost of direct labor ($)

- OM is the overhead manufacturing cost ($)

- EI is the ending inventory value ($)

Cost of Sales Definition

A cost of sales is defined as the total value of costs involved in the production of a good or service.

Are cost of sales fixed or variable?

A cost of sales is a variable metric that depends on factors that can change with time such as raw material costs, direct labor costs, etc.

What factors affect cost of sales?

The following list includes the factors that affect the cost of sales of a product or business.

- The beginning inventory value. This is the total value of your inventory or product at the beginning of the period.

- Ending inventory value. This is the total value of the same product at the end of the period.

- Raw material cost. This is the cost of the raw material used in the production of the product during the time period.

- Direct labor costs. This is the total cost of labor that was used to directly produce the product.

- Overhead costs. This includes any other costs associated with the product that aren’t included in the direct labor costs.

Why are cost of sales important?

A cost of sale is an important metric in understanding the total operational costs that go into producing a service or good. When the cost of sales rises, there should be an almost equal rise in revenue. If there is not, then this means the company is becoming less and less profitable since the profit is equal to the revenue minus the cost of sales. Inversely, if the cost of sales is decreasing but the revenue is staying the same, then the profit is increasing and the company is doing a good job of managing costs.

Can costs of sales be negative?

The costs of sales can be negative if the ending inventory value of the period being analyzed is larger than the sum of the other factors. This typically only happens if a large amount of product is returned to a business during a time period. In this case, however, the revenue during the time would also be negative.

Cost of Sales Example

How to calculate cost of sales?

- First, determine the beginning inventory value.

This will be the total value of all inventory at the start of the period being analyzed. For this example, this value is $500.00.

- Next, determine the cost of raw material.

This will be only the cost of the raw material used to directly make the goods. For this example, this is $400.00.

- Next, determine the cost of direct labor.

Again, this is only labor that was directly used to produce the product. For this example, the direct labor is $200.00.

- Next, determine the manufacturing overhead.

Calculate the total manufacturing overhead used. For this example, the overhead is $100.00.

- Next, determine the ending inventory.

Calculate the total value of the inventory at the end of the period being analyzed. For this example, the ending inventory value is $200.00.

- Finally, calculate the cost of sales.

Calculate the cost of sales using the formula above. So, COS = 500+400+200+100-200 = $1,000.00.

FAQ

Cost of sales is a measure of the total costs associated with producing a good or service. This is typically a physical good but can be associated with software and services as well.