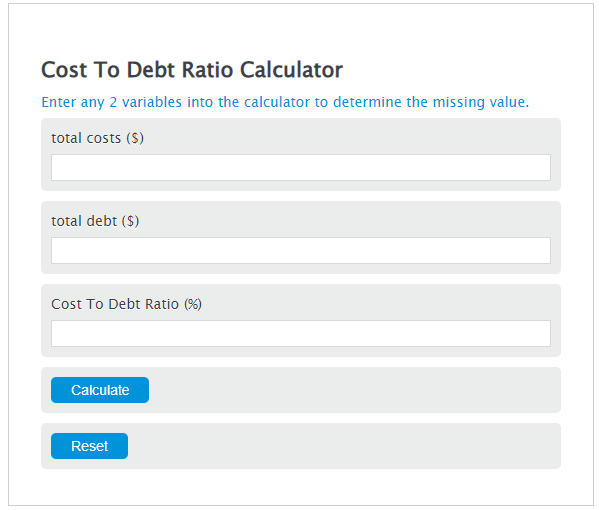

Enter the total costs ($) and the total debt ($) into the Calculator. The calculator will evaluate the Cost To Debt Ratio.

Cost To Debt Ratio Formula

C:D = C / D * 100

Variables:

- C:D is the Cost To Debt Ratio (%)

- C is the total costs ($)

- D is the total debt ($)

To calculate Cost To Debt Ratio, divide the costs by the debt, then multiply by 100 to express the result as a percentage.

How to Calculate Cost To Debt Ratio?

The following steps outline how to calculate the Cost To Debt Ratio.

- First, determine the total costs ($).

- Next, determine the total debt ($).

- Next, gather the formula from above = C:D = C / D * 100.

- Finally, calculate the Cost To Debt Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total costs ($) = 46

total debt ($) = 80

FAQs

What is the significance of the Cost To Debt Ratio?

The Cost To Debt Ratio is a financial metric used to determine how much a company or individual pays in costs relative to their total debt. A lower ratio indicates that the entity is managing its debt efficiently in relation to its costs, which can be an indicator of good financial health.

How can the Cost To Debt Ratio affect a company’s financial decisions?

A higher Cost To Debt Ratio might signal to a company that it’s time to reassess its spending or debt management strategies. This ratio can influence decisions on whether to take on more debt, invest in new projects, or cut costs to improve financial stability.

Can individuals use the Cost To Debt Ratio for personal finance?

Yes, individuals can use the Cost To Debt Ratio to assess their own financial health, especially when managing personal debt, such as loans or credit cards. It can help in making informed decisions about budgeting, saving, and spending.

Is there an ideal Cost To Debt Ratio?

There isn’t a one-size-fits-all ideal ratio, as it can vary by industry, company size, and individual financial situations. Generally, a lower ratio is preferable as it indicates that costs are being effectively managed in relation to debt. However, it’s important to compare ratios within the same industry for a more accurate assessment.