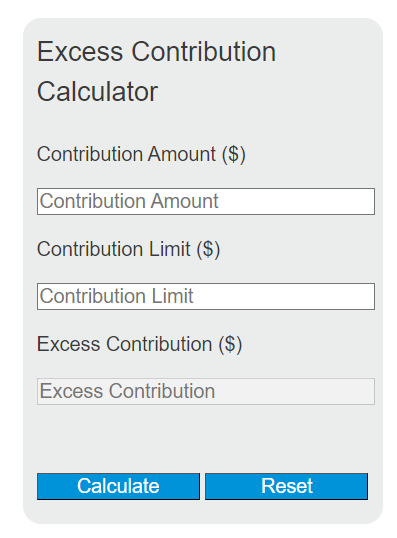

Enter the contribution amount and the contribution limit into the calculator to determine the excess contribution. This calculator helps you identify any amount that exceeds the allowable limit for contributions to retirement accounts, health savings accounts, or other similar accounts.

Excess Contribution Formula

The following formula is used to calculate the excess contribution.

EC = C - L

Variables:

- EC is the excess contribution ($)

- C is the contribution amount ($)

- L is the contribution limit ($)

To calculate the excess contribution, subtract the contribution limit from the contribution amount. If the result is negative, the excess contribution is zero.

What is an Excess Contribution?

An excess contribution refers to the amount of money contributed to a tax-advantaged account that exceeds the annual limit set by tax regulations. This can occur in retirement accounts like IRAs, 401(k)s, or health savings accounts (HSAs). Excess contributions can be subject to penalties if not corrected in a timely manner. It is important to monitor contributions to avoid these penalties.

How to Calculate Excess Contribution?

The following steps outline how to calculate the Excess Contribution.

- First, determine the contribution amount (C) in dollars.

- Next, determine the contribution limit (L) in dollars.

- Next, gather the formula from above = EC = C – L.

- Finally, calculate the Excess Contribution (EC) in dollars.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Contribution amount (C) = $5,500

Contribution limit (L) = $5,000