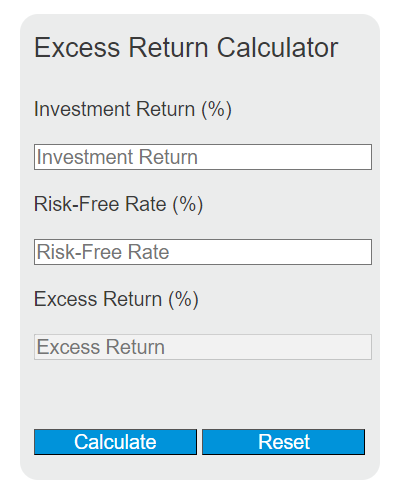

Enter the investment return and the risk-free rate into the calculator to determine the excess return. This calculator helps to evaluate the performance of an investment relative to a risk-free asset.

Excess Return Formula

The following formula is used to calculate the excess return:

ER = IR - RFR

Variables:

- ER is the excess return (%)

- IR is the investment return (%)

- RFR is the risk-free rate (%)

To calculate the excess return, subtract the risk-free rate from the investment return.

What is Excess Return?

Excess return is the difference between the return of an investment and the return of a risk-free benchmark, such as a government treasury bond. It represents the additional gain (or loss) that an investor receives (or incurs) from taking on the additional risk compared to a risk-free investment. Excess return is a common measure used in finance to assess the performance of investment portfolios and individual securities.

How to Calculate Excess Return?

The following steps outline how to calculate the Excess Return.

- First, determine the investment return (IR) as a percentage.

- Next, determine the risk-free rate (RFR) as a percentage.

- Use the formula from above = ER = IR – RFR.

- Finally, calculate the Excess Return (ER) as a percentage.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Investment return (IR) = 8%

Risk-free rate (RFR) = 2%