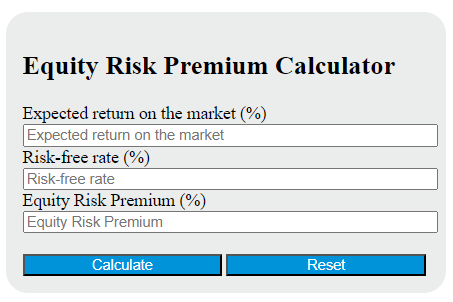

Enter the expected return on the market and the risk-free rate into the calculator to determine the Equity Risk Premium. This calculator can also evaluate any of the variables given the others are known.

Equity Risk Premium Formula

The following formula is used to calculate the Equity Risk Premium.

ERP = Rm - Rf

Variables:

- ERP is the Equity Risk Premium (%)

- Rm is the expected return on the market (%)

- Rf is the risk-free rate (%)

To calculate the Equity Risk Premium, subtract the risk-free rate from the expected return on the market. The result is the Equity Risk Premium, which represents the excess return that investing in the stock market provides over a risk-free rate. This excess return compensates investors for taking on the relatively higher risk of the equity market. The size of the premium varies and depends on the level of risk in a particular portfolio and market conditions.

What is an Equity Risk Premium?

Equity Risk Premium is the excess return that an individual stock or the overall stock market provides over a risk-free rate. This excess return compensates investors for taking on the relatively higher risk of equity investing. The size of the premium varies and depends on the level of risk in a particular investment or market. It is an important concept in financial investing and fundamental to the Capital Asset Pricing Model (CAPM).

How to Calculate Equity Risk Premium?

The following steps outline how to calculate the Equity Risk Premium (ERP).

- First, determine the expected return on the market (Rm) (%).

- Next, determine the risk-free rate (Rf) (%).

- Next, gather the formula from above = ERP = Rm – Rf.

- Finally, calculate the Equity Risk Premium (ERP).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Expected return on the market (Rm) (%) = 10

Risk-free rate (Rf) (%) = 2