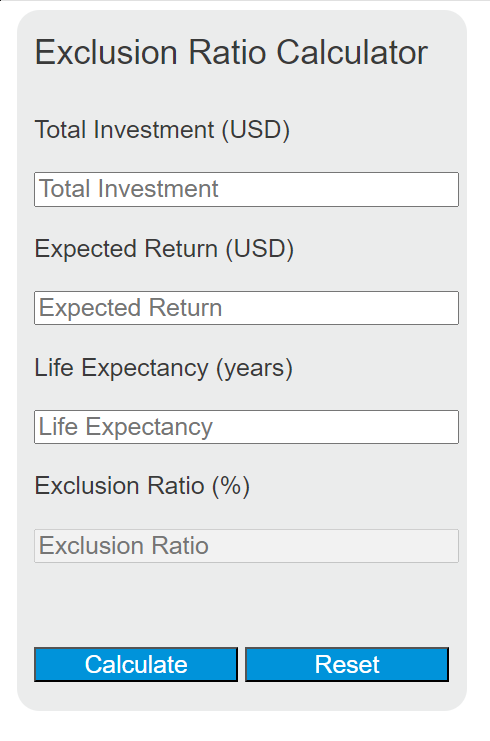

Enter the total investment, expected return, and life expectancy into the calculator to determine the exclusion ratio. This ratio helps in understanding the portion of an annuity payment that is considered a return of the original investment and is not taxable.

Exclusion Ratio Formula

The following formula is used to calculate the exclusion ratio:

ER = left( frac{Investment}{Expected Return} right) times left( frac{1}{Life Expectancy} right) times 100%Variables:

- ER is the exclusion ratio (%)

- Investment is the total amount invested (USD)

- Expected Return is the total amount expected to be returned over the life of the investment (USD)

- Life Expectancy is the expected number of years the return will be received (years)

To calculate the exclusion ratio, divide the total investment by the expected return, then divide by the life expectancy, and finally multiply by 100 to get the percentage.

What is an Exclusion Ratio?

The exclusion ratio is a percentage that represents the portion of an annuity payment that is a return of the original investment. This portion is not subject to income tax. The ratio is used to determine how much of each annuity payment received is taxable and how much is considered a tax-free return of the investment.

How to Calculate Exclusion Ratio?

The following steps outline how to calculate the Exclusion Ratio:

- First, determine the total amount invested (Investment) in USD.

- Next, determine the total expected return (Expected Return) in USD.

- Next, determine the life expectancy (Life Expectancy) in years.

- Next, gather the formula from above = ER = (Investment / Expected Return) * (1 / Life Expectancy) * 100%.

- Finally, calculate the Exclusion Ratio (ER) in percentage.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Total Investment (Investment) = $100,000 USD

Expected Return (Expected Return) = $150,000 USD

Life Expectancy (Life Expectancy) = 20 years