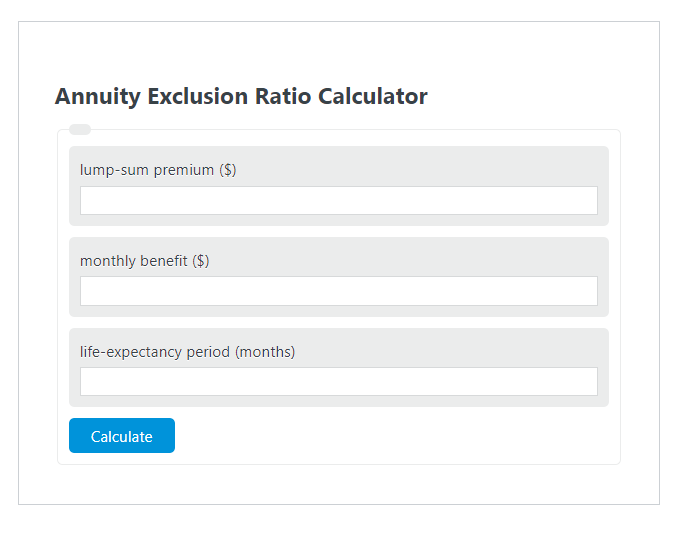

Enter the lump-sum premium ($), the monthly benefit ($), and the life-expectancy period (months) into the Annuity Exclusion Ratio Calculator. The calculator will evaluate and display the Annuity Exclusion Ratio.

- All Ratio Calculators

- Return on Annuity Calculator

- Annuity Cost Calculator

- Ordinary Annuity Calculator

- Reverse Annuity Calculator

Annuity Exclusion Ratio Formula

The following formula is used to calculate the Annuity Exclusion Ratio.

AER = LS / (MB * LE)

- Where AER is the Annuity Exclusion Ratio

- LS is the lump-sum premium ($)

- MB is the monthly benefit ($)

- LE is the life-expectancy period (months)

To calculate the annuity exclusion ratio, divide the lump sum premium by the product of the monthly benefit and the life-expectancy period.

How to Calculate Annuity Exclusion Ratio?

The following example problems outline how to calculate Annuity Exclusion Ratio.

Example Problem #1

- First, determine the lump-sum premium ($).

- The lump-sum premium ($) is calculated to be : 100,000.

- Next, determine the monthly benefit ($).

- The monthly benefit ($) is measured to be: 560.

- Next, determine the life-expectancy period (months).

- The life-expectancy period (months) is found to be: 200.

- Finally, calculate the Annuity Exclusion Ratio using the formula above:

AER = LS / (MB * LE) * 100

The values given above are inserted into the equation below and the solution is calculated:

AER = 100000 / (560 * 200) * 100 = 89.285 (%)

Example Problem #2

The variables required for this problem are provided below:

lump-sum premium ($) = 200,000

monthly benefit ($) = 700

life-expectancy period (months) = 200

Test your knowledge using the equation and check your answer with the calculator above.

AER = LS / (MB * LE) * 100 = (%)