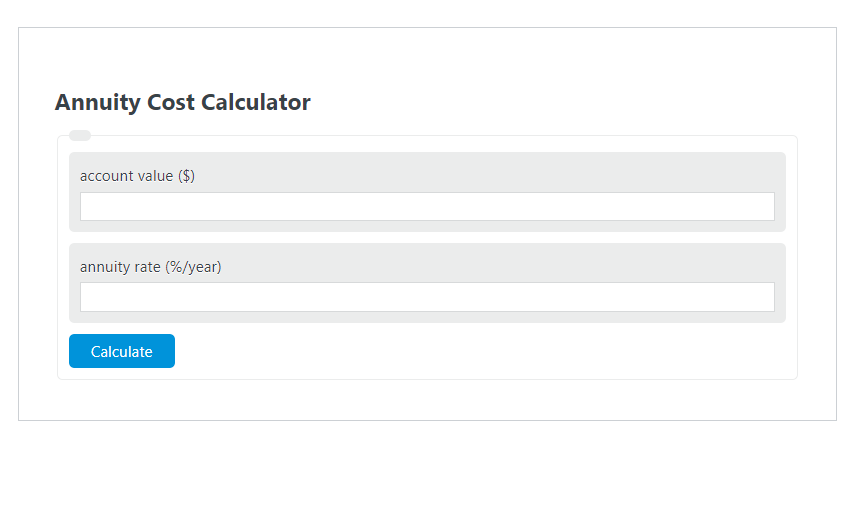

Enter the account value ($) and the annuity rate (%/year) into the Annuity Cost Calculator. The calculator will evaluate and display the Annuity Cost.

Annuity Cost Formula

The following formula is used to calculate the Annuity Cost.

AC = AV * AR/100

- Where AC is the Annuity Cost ($/year)

- AV is the account value ($)

- AR is the annuity rate (%/year)

To calculate the annuity cost, multiply the account value by the annuity rate.

How to Calculate Annuity Cost?

The following example problems outline how to calculate Annuity Cost.

Example Problem #1:

- First, determine the account value ($). The account value ($) is given as 14000.

- Next, determine the annuity rate (%/year). The annuity rate (%/year) is provided as 4.

- Finally, calculate the Annuity Cost using the equation above:

AC = AV * AR/100

The values given above are inserted into the equation below:

AC = 14,000* 4/100 = 560.00 ($/year)

FAQ

What is an annuity?

An annuity is a financial product that pays out a fixed stream of payments to an individual, primarily used as an income stream for retirees. It’s a contract between an individual and an insurance company where the individual pays a lump sum or a series of payments in exchange for regular disbursements that can start either immediately or at some point in the future.

How does the annuity rate affect the annuity cost?

The annuity rate directly influences the annuity cost. A higher annuity rate means that the individual will receive a higher amount of money annually, based on the account value. The annuity cost, calculated as the account value multiplied by the annuity rate, represents the annual cost of the annuity to the insurer or the annual payout to the annuitant, depending on the context.

Can the annuity cost change over time?

Yes, the annuity cost can change over time if the annuity rate or the account value changes. For fixed annuities, the annuity cost typically remains the same because the annuity rate is locked in at the purchase. However, for variable annuities, the cost can vary because the account value can fluctuate with the performance of the underlying investment options. Additionally, some annuities offer options to add riders or make other changes that could affect the cost.