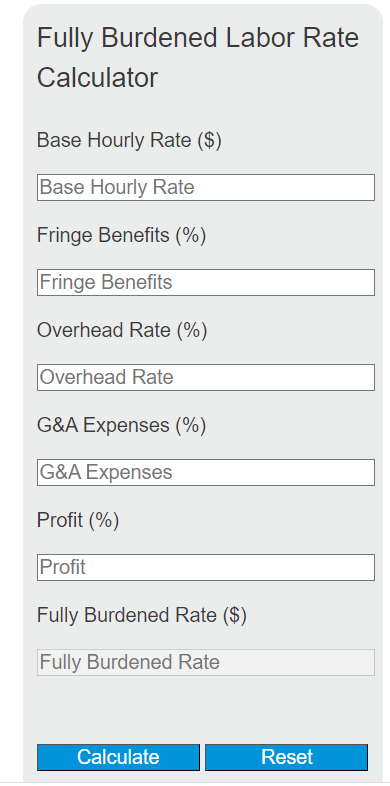

Enter the base hourly rate and the percentages for fringe benefits, overhead, G&A expenses, and profit into the calculator to determine the fully burdened labor rate.

Fully Burdened Labor Rate Formula

The following formula is used to calculate the fully burdened labor rate.

FBLR = BR * (1 + FB + OH + GA + P)

Variables:

- FBLR is the fully burdened labor rate ($)

- BR is the base hourly rate ($)

- FB is the fringe benefits (%)

- OH is the overhead rate (%)

- G&A is the general and administrative expenses (%)

- P is the profit (%)

To calculate the fully burdened labor rate, multiply the base hourly rate by the sum of 1 and the percentages of fringe benefits, overhead rate, G&A expenses, and profit, all converted to decimal form.

What is a Fully Burdened Labor Rate?

The fully burdened labor rate is the total hourly cost to employ a worker, including the base hourly wage plus all associated costs such as fringe benefits, overhead, general and administrative expenses, and profit. This rate is often used in project costing, budgeting, and pricing to ensure all labor-related expenses are accounted for.

How to Calculate Fully Burdened Labor Rate?

The following steps outline how to calculate the Fully Burdened Labor Rate.

- First, determine the base hourly rate (BR).

- Next, determine the fringe benefits (FB) as a percentage of the base rate.

- Next, determine the overhead rate (OH) as a percentage of the base rate.

- Next, determine the general and administrative expenses (G&A) as a percentage of the base rate.

- Next, determine the profit (P) as a percentage of the base rate.

- Next, gather the formula from above = FBLR = BR * (1 + FB + OH + G&A + P).

- Finally, calculate the Fully Burdened Labor Rate (FBLR).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Base hourly rate (BR) = $30.00

Fringe benefits (FB) = 20%

Overhead rate (OH) = 15%

General and administrative expenses (G&A) = 10%

Profit (P) = 10%