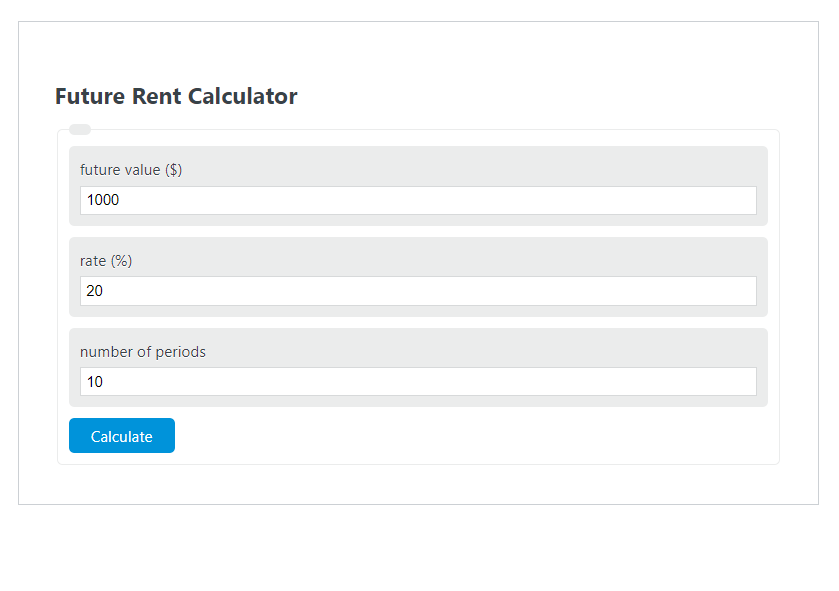

Enter the future value ($), the rate (%), and the number of periods into the calculator to determine the Present Value of Future Rent.

- All Rent Calculators

- Land Rent Rate of Return Calculator

- Straight Line Rent Calculator

- Late Rent Calculator

Present Value of Future Rent Formula

The following formula is used to calculate the Present Value of Future Rent.

PVf = FV / (1+r)^n

- Where PVf is the Present Value of Future Rent ($)

- FV is the future value ($)

- r is the rate (%)

- n is the number of periods

To calculate the present value of future rent, divide the future value by 1 plus the rate raised to the number of periods.

How to Calculate the Present Value of Future Rent?

The following example problems outline how to calculate Present Value of Future Rent.

Example Problem #1

- First, determine the future value ($). In this example, the future value ($) is given as 1000 .

- Next, determine the rate (%). For this problem, the rate (%) is given as .2 .

- Next, determine the number of periods. In this case, the number of periods is found to be 10.

- Finally, calculate the Present Value of Future Rent using the formula above:

PVf = FV / (1+r)^n

Inserting the values from above yields:

PVf = 1000 / (1+.2)^10 = 161.505 ($)

FAQ

What factors can affect the future value of rent?

The future value of rent can be influenced by several factors including inflation rates, changes in the real estate market, the condition and location of the property, and changes in demand for rental properties. Economic conditions and government policies can also play significant roles.

How can the present value of future rent be used in real estate investment?

The present value of future rent is a crucial metric for real estate investors as it helps in evaluating the profitability of an investment property. By calculating the present value, investors can determine if the future income from the property is worth the current investment, allowing them to make informed decisions on purchasing or selling properties.

Is it better to have a higher or lower present value of future rent?

A higher present value of future rent indicates that the expected income from the property, when adjusted for the time value of money, is substantial. This is generally seen as favorable for investors, as it suggests that the property is likely to be a good investment. However, it's important to consider other factors such as property maintenance costs, taxes, and potential vacancy periods which can affect the overall profitability.