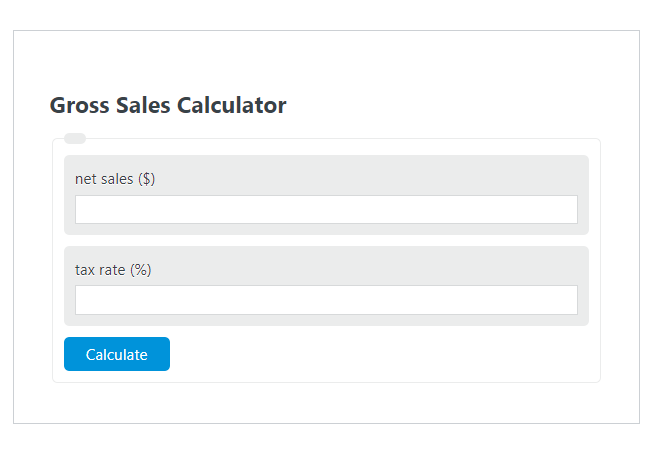

Enter the net sales ($) and the tax rate (%) into the Gross Sales Calculator. The calculator will evaluate and display the Gross Sales.

Gross Sales Formula

The following formula is used to calculate the Gross Sales.

GS = NS/(1-TR/100)

- Where GS is the Gross Sales ($)

- NS is the net sales ($)

- TR is the tax rate (%)

To calculate the gross sales, divide the net sales by 1 minus the tax rate.

How to Calculate Gross Sales?

The following example problems outline how to calculate Gross Sales.

Example Problem #1:

- First, determine the net sales ($).

- The net sales ($) is given as: 50.

- Next, determine the tax rate (%).

- The tax rate (%) is provided as: 3.

- Finally, calculate the Gross Sales using the equation above:

GS = NS/(1-TR/100)

The values given above are inserted into the equation below:

GS = 50/(1-3/100) = 51.54 ($)

FAQ

What is the difference between Gross Sales and Net Sales?

Gross Sales refer to the total sales amount before any deductions like returns, discounts, and allowances. Net Sales, on the other hand, is the amount left after these deductions are made from the Gross Sales. Essentially, Net Sales = Gross Sales – Returns/Allowances/Discounts.

How does the tax rate affect Gross Sales calculation?

The tax rate affects the Gross Sales calculation by adjusting the net sales amount to reflect the total sales before taxes. A higher tax rate increases the difference between net and gross sales, as it implies more tax was deducted from the gross amount to arrive at the net sales figure.

Can Gross Sales be lower than Net Sales?

No, Gross Sales cannot be lower than Net Sales. Gross Sales represent the total sales without any deductions, while Net Sales are calculated after subtracting returns, allowances, discounts, and taxes from the Gross Sales. Therefore, Net Sales will always be equal to or less than Gross Sales.