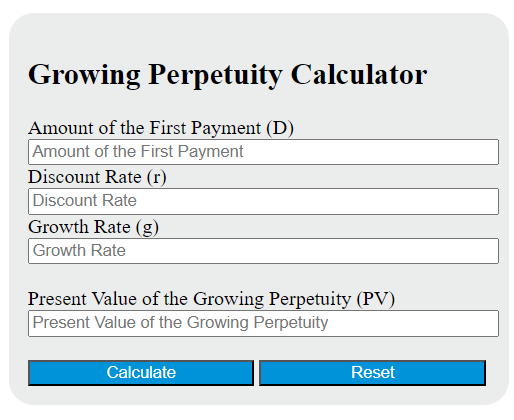

Enter the amount of the first payment, discount rate, and growth rate into the calculator to determine the present value of a growing perpetuity.

Growing Perpetuity Formula

The following formula is used to calculate the present value of a growing perpetuity.

PV = D / (r - g)

Variables:

- PV is the present value of the growing perpetuity

- D is the amount of the first payment

- r is the discount rate

- g is the growth rate

To calculate the present value of a growing perpetuity, divide the amount of the first payment by the difference between the discount rate and the growth rate.

What is a Growing Perpetuity?

A growing perpetuity is a series of periodic payments that grow at a proportionate rate and continue indefinitely. It is a type of perpetuity, which is an infinite series of payments. The concept is often used in finance to determine the present value of a company’s cash flows, dividends, or other financial metrics that are expected to grow at a constant rate over an indefinite period. The formula for calculating the present value of a growing perpetuity takes into account the initial payment, the growth rate, and the discount rate.

How to Calculate Growing Perpetuity?

The following steps outline how to calculate the Present Value of a Growing Perpetuity.

- First, determine the amount of the first payment (D).

- Next, determine the discount rate (r).

- Next, determine the growth rate (g).

- Next, gather the formula from above = PV = D / (r – g).

- Finally, calculate the Present Value of the Growing Perpetuity.

- After inserting the variables and calculating the result, check your answer with a financial calculator or spreadsheet.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Amount of the first payment (D) = $100

Discount rate (r) = 0.05

Growth rate (g) = 0.03