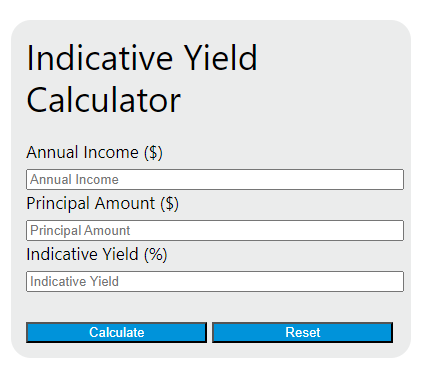

Enter the annual income from the investment and the principal amount invested into the calculator to determine the indicative yield. This calculator can also evaluate any of the variables given the others are known.

- Bond Equivalent Yield Calculator (+ Formula)

- Taxable Equivalent Yield Calculator

- Bond Dirty Price Calculator

Indicative Yield Formula

The following formula is used to calculate the indicative yield.

IY = (AI / P) * 100

Variables:

- IY is the indicative yield (%)

- AI is the annual income from the investment ($)

- P is the principal amount invested ($)

To calculate the indicative yield, divide the annual income from the investment by the principal amount invested. Multiply the result by 100 to convert it into a percentage. This will give you the indicative yield, which represents the estimated return on the investment based on historical data or projected performance. However, keep in mind that the actual yield may vary depending on market conditions and the performance of the investment.

What is an Indicative Yield?

Indicative yield refers to the estimated return on an investment, usually expressed as a percentage, based on historical data or projected performance. It is often used in the context of bonds or fixed-income securities to indicate the potential income an investor can expect to receive. However, it’s important to note that the actual yield may vary depending on market conditions and the performance of the investment.

How to Calculate Indicative Yield?

The following steps outline how to calculate the Indicative Yield.

- First, determine the annual income from the investment (AI) in dollars ($).

- Next, determine the principal amount invested (P) in dollars ($).

- Next, use the formula IY = (AI / P) * 100 to calculate the Indicative Yield.

- Finally, calculate the Indicative Yield.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Annual income from the investment (AI) = $500

Principal amount invested (P) = $10000