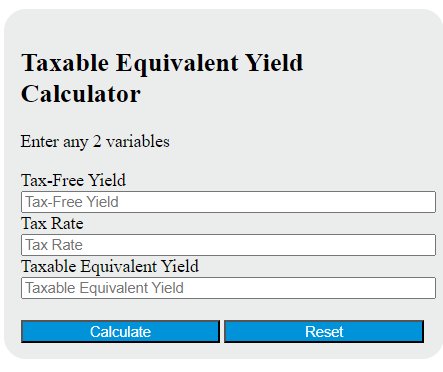

Enter the tax-free yield and the tax rate into the calculator to determine the taxable equivalent yield. This calculator can also evaluate any of the variables given the others are known.

Taxable Equivalent Yield Formula

The following formula is used to calculate the taxable equivalent yield.

TEY = (TY / (1 - TR))

Variables:

- TEY is the taxable equivalent yield

- TY is the tax-free yield

- TR is the tax rate

To calculate the taxable equivalent yield, divide the tax-free yield by the difference of 1 and the tax rate.

What is a Taxable Equivalent Yield?

Taxable Equivalent Yield (TEY) is a calculation that allows investors to compare the yield on a tax-free bond to that of a taxable bond. It is used to determine the minimum yield a taxable bond must have to equal the yield of a tax-free bond. This is particularly useful for investors in high tax brackets who may benefit more from tax-free bonds. The formula for TEY takes into account the yield of the tax-free bond and the investor’s tax rate.

How to Calculate Taxable Equivalent Yield?

The following steps outline how to calculate the Taxable Equivalent Yield (TEY).

- First, determine the tax-free yield (TY).

- Next, determine the tax rate (TR).

- Next, gather the formula from above = TEY = TY / (1 – TR).

- Finally, calculate the Taxable Equivalent Yield (TEY).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

tax-free yield (TY) = 0.05

tax rate (TR) = 0.25