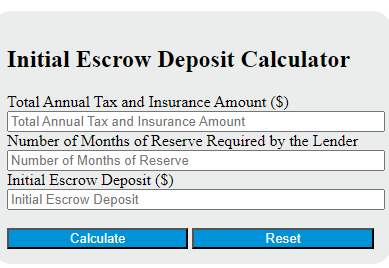

Enter the total annual tax and insurance amount and the number of months of reserve required by the lender into the calculator to determine the initial escrow deposit. This calculator can also evaluate any of the variables given the others are known.

- Escrow Shortage Calculator

- Certificate of Deposit Return Calculator (CD Calculator)

- Interest Difference Calculator

Initial Escrow Deposit Formula

The following formula is used to calculate the initial escrow deposit.

IED = (T / 12) * M

Variables:

- IED is the initial escrow deposit ($)

- T is the total annual tax and insurance amount ($)

- M is the number of months of reserve required by the lender

To calculate the initial escrow deposit, divide the total annual tax and insurance amount by 12 to get the monthly amount. Then, multiply this monthly amount by the number of months of reserve required by the lender.

What is an Initial Escrow Deposit?

An Initial Escrow Deposit is the initial amount of money a buyer puts into an escrow account when purchasing a property. This deposit serves as a good faith gesture, demonstrating the buyer’s serious intent to complete the transaction. The funds in the escrow account are held by a neutral third party and are used to cover closing costs or returned to the buyer if the sale does not go through. The amount of the initial escrow deposit can vary, but it is typically around 1-2% of the purchase price of the property.

How to Calculate Initial Escrow Deposit?

The following steps outline how to calculate the Initial Escrow Deposit.

- First, determine the total annual tax and insurance amount ($).

- Next, determine the number of months of reserve required by the lender.

- Next, gather the formula from above = IED = (T / 12) * M.

- Finally, calculate the Initial Escrow Deposit.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

total annual tax and insurance amount ($) = 1200

number of months of reserve required by the lender = 6