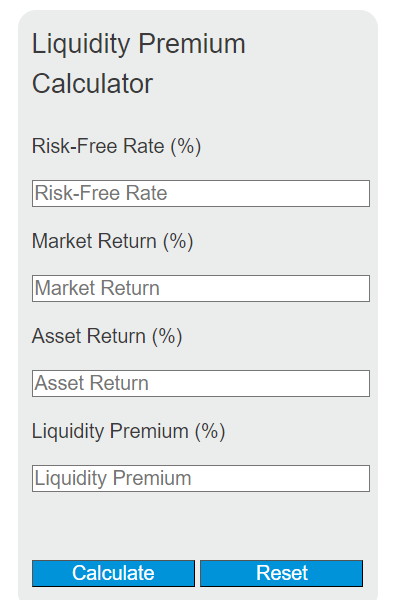

Enter the risk-free rate, market return, and asset return into the calculator to determine the liquidity premium. The liquidity premium is the excess return that an investor demands for investing in a less liquid asset.

Liquidity Premium Formula

The following formula is used to calculate the liquidity premium:

LP = AR - (RFR + (MR - RFR))

Variables:

- LP is the liquidity premium (%)

- AR is the asset return (%)

- RFR is the risk-free rate (%)

- MR is the market return (%)

To calculate the liquidity premium, subtract the sum of the risk-free rate and the excess return of the market over the risk-free rate from the asset return.

What is a Liquidity Premium?

A liquidity premium is the additional return that investors require to hold an asset that is not easily traded or sold. It compensates for the risk of not being able to quickly convert the asset into cash without a significant loss in value. Assets that are considered less liquid, such as real estate or certain types of bonds, typically have a higher liquidity premium compared to more liquid assets like stocks or government bonds.

How to Calculate Liquidity Premium?

The following steps outline how to calculate the Liquidity Premium:

- First, determine the risk-free rate (RFR) in percentage.

- Next, determine the market return (MR) in percentage.

- Next, determine the asset return (AR) in percentage.

- Next, gather the formula from above = LP = AR – (RFR + (MR – RFR)).

- Finally, calculate the Liquidity Premium (LP) in percentage.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Risk-free rate (RFR) = 2%

Market return (MR) = 8%

Asset return (AR) = 10%