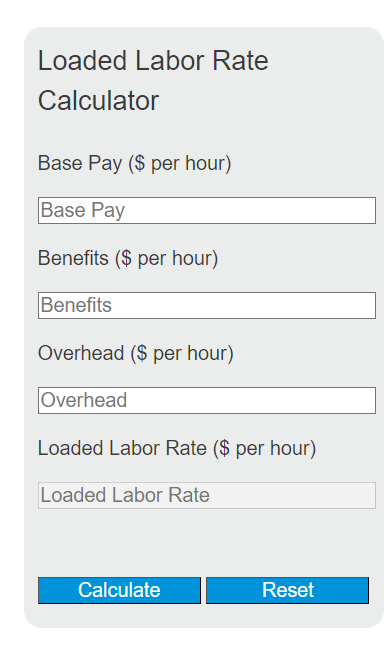

Enter the base pay, benefits, and overhead into the calculator to determine the loaded labor rate. This calculator helps in understanding the true cost of an employee per hour.

Loaded Labor Rate Formula

The following formula is used to calculate the loaded labor rate.

LLR = BP + B + O

Variables:

- LLR is the loaded labor rate ($ per hour)

- BP is the base pay ($ per hour)

- B is the benefits ($ per hour)

- O is the overhead ($ per hour)

To calculate the loaded labor rate, add the base pay, benefits, and overhead costs together. This will give you the total cost of an employee per hour, including all associated expenses.

What is a Loaded Labor Rate?

The loaded labor rate is the total hourly cost to employ a worker, including base salary, benefits, and overhead. This rate is often used in project costing and budgeting to estimate the true cost of labor. It provides a more accurate picture of employment costs than just the hourly wage or salary.

How to Calculate Loaded Labor Rate?

The following steps outline how to calculate the Loaded Labor Rate.

- First, determine the base pay (BP) of the employee in dollars per hour.

- Next, determine the hourly cost of benefits (B) for the employee.

- Next, determine the hourly overhead cost (O) associated with the employee.

- Next, gather the formula from above = LLR = BP + B + O.

- Finally, calculate the Loaded Labor Rate (LLR) in dollars per hour.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Base Pay (BP) = $25.00 per hour

Benefits (B) = $5.00 per hour

Overhead (O) = $10.00 per hour