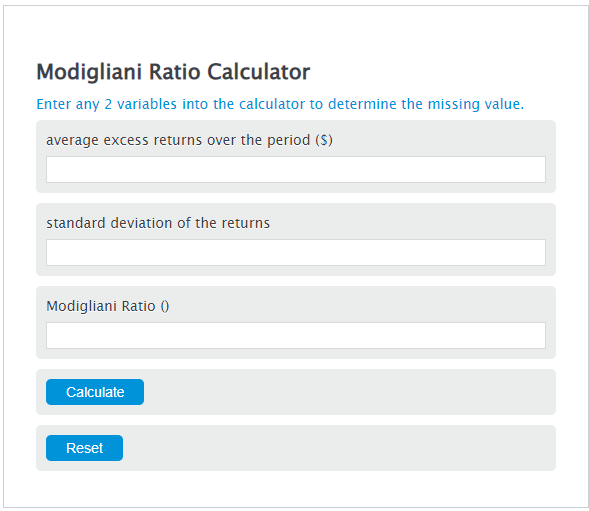

Enter the average excess returns over the period ($) and the standard deviation of the returns into the Calculator. The calculator will evaluate the Modigliani Ratio.

Modigliani Ratio Formula

MR = AER / SD

Variables:

- MR is the Modigliani Ratio ()

- AER is the average excess returns over the period ($)

- SD is the standard deviation of the returns

To calculate Modigliani Ratio, divide the excess return of the period by the standard deviation of the returns.

How to Calculate Modigliani Ratio?

The following steps outline how to calculate the Modigliani Ratio.

- First, determine the average excess returns over the period ($).

- Next, determine the standard deviation of the returns.

- Next, gather the formula from above = MR = AER / SD.

- Finally, calculate the Modigliani Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

average excess returns over the period ($) = 500

standard deviation of the returns = 2.5

FAQs

What is the significance of the Modigliani Ratio in investment analysis?

The Modigliani Ratio, or M2 measure, is significant in investment analysis as it adjusts the risk of a portfolio to match the market risk, allowing for a direct comparison of performance. It essentially measures the risk-adjusted return of a portfolio, making it easier to compare the performance of various investments irrespective of their risk levels.

How does the Modigliani Ratio differ from the Sharpe Ratio?

While both the Modigliani Ratio and the Sharpe Ratio measure risk-adjusted returns, the Modigliani Ratio adjusts the portfolio’s returns to a market level of risk, allowing for comparison with the market or other investments directly. In contrast, the Sharpe Ratio measures how much excess return you receive for the extra volatility that you endure for holding a riskier asset, without adjusting the portfolio’s risk level to a common benchmark.

Can the Modigliani Ratio be negative?

Yes, the Modigliani Ratio can be negative. A negative Modigliani Ratio indicates that the portfolio has underperformed its benchmark or the risk-free rate of return, considering the portfolio’s risk level. This suggests that the investment’s average excess returns do not justify its volatility or risk.

What role does the standard deviation play in calculating the Modigliani Ratio?

The standard deviation in the Modigliani Ratio calculation represents the volatility or risk of the portfolio’s returns. A higher standard deviation indicates greater volatility, which typically requires a higher return to compensate for the increased risk. In the Modigliani Ratio formula, dividing the average excess return by the standard deviation adjusts the return for risk, facilitating a fair comparison of different investments.