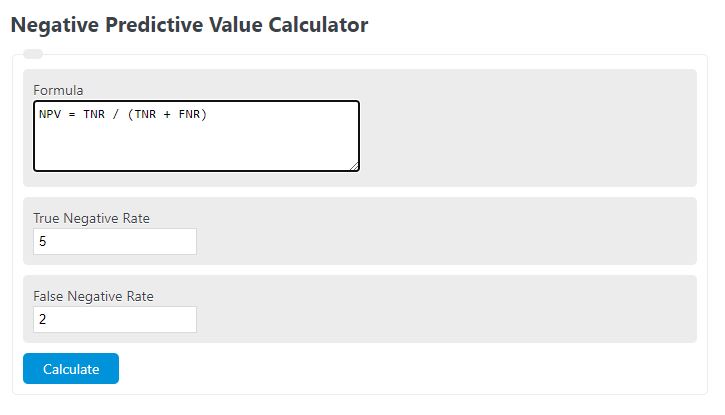

Enter the true negative rate and the false-negative rate into the calculator to determine the negative predicted value.

Negative Predictive Value Formula

The following formula is used to calculate a negative predictive value.

NPV = TNR / (TNR + FNR)

- Where NPV is the negative predictive value

- TNR is the true negative rate

- FNR is the false negative rate

The true negative rate refers to the proportion of actual negative cases that are correctly identified as negative by a diagnostic test or model.

The false negative rate refers to the proportion of negative results that are incorrectly identified as positive in a diagnostic test or classification model.

Negative Predictive Value Definition

Negative Predictive Value (NPV) is a statistical measure that assesses the probability of a negative test result accurately indicating the absence of a particular condition or disease in an individual. It is calculated by dividing the number of true negative results by the sum of true negative and false positive results and is expressed as a percentage.

NPV is crucial because it helps determine the reliability of a diagnostic test in ruling out a condition. A high NPV indicates that a negative test result is highly likely accurate, meaning that the individual is unlikely to have the condition. This is particularly important when the condition being tested for is severe or potentially life-threatening.

For example, in medical screening, a high NPV is desirable as it assures that a negative test result can reassure patients, allowing them to avoid unnecessary further testing or treatment. Similarly, in population-based screening programs, a high NPV is important to minimize the chances of false-negative results, ensuring that individuals without the condition are not mistakenly identified as being disease-free.

Negative Predictive Value Example

How to calculate negative predictive value?

- First determine the true negative rate.

Calculate the rate at which a true negative test result is found.

- Next, determine the false negative rate.

Calculate the rate at which a negative test results in a false negative.

- Finally, calculate the negative predictive value.

Using the formula, calculate the NPV.

Frequently Asked Questions (FAQ)

What causes negative equity?

Negative equity can occur due to a decline in the value of an asset, such as a house or vehicle, after purchase. It can also result from taking out a loan with a high interest rate or with 0% down payment, where the total amount owed becomes more than the asset's current market value.

Can negative equity be reversed?

Yes, negative equity can be reversed through various means such as paying down the principal of the loan to reduce the amount owed, waiting for the asset's value to increase over time, or refinancing the loan under more favorable terms.

How does negative equity affect selling an asset?

When selling an asset with negative equity, the seller may have to pay the difference between the sale price and the amount owed on the loan. This situation is often referred to as being "upside down" on a loan and can complicate the process of selling the asset.

Is it possible to transfer negative equity?

In some cases, it is possible to transfer negative equity to a new loan, particularly with vehicles. This means adding the amount of negative equity to the loan amount of a new purchase. However, this can lead to higher monthly payments and more interest over the life of the new loan.