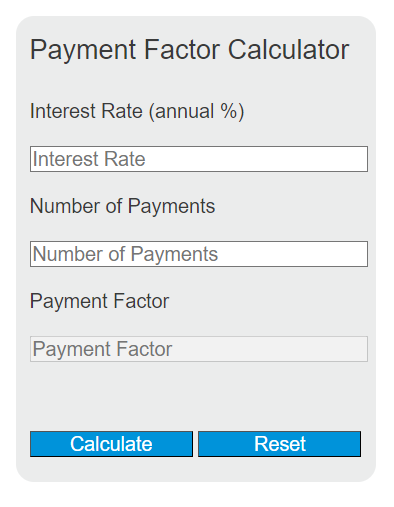

Enter the annual interest rate and the number of payments into the calculator to determine the payment factor. This calculator helps in understanding the proportion of each payment that will go towards interest.

Payment Factor Formula

The following formula is used to calculate the payment factor:

PF = (i * (1 + i)^n) / ((1 + i)^n - 1)

Variables:

- PF is the payment factor

- i is the monthly interest rate (annual interest rate / 12 / 100)

- n is the number of payments

To calculate the payment factor, multiply the monthly interest rate by the power of (1 plus the monthly interest rate) raised to the number of payments, then divide by the power of (1 plus the monthly interest rate) raised to the number of payments minus 1.

What is a Payment Factor?

A payment factor is a figure that, when multiplied by the principal amount of a loan, gives the periodic payment amount needed to pay off the loan over the specified number of payments with a certain interest rate. It is a useful tool for financial planning and for understanding the cost of borrowing over time.

How to Calculate Payment Factor?

The following steps outline how to calculate the Payment Factor.

- First, determine the annual interest rate and convert it to a monthly rate by dividing by 12 and then by 100 to get a decimal.

- Next, determine the total number of payments (n).

- Use the formula PF = (i * (1 + i)^n) / ((1 + i)^n – 1) to calculate the payment factor.

- Finally, use the payment factor to determine the periodic payment amount by multiplying it by the principal amount of the loan.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Annual interest rate = 6%

Number of payments = 360 (30 years of monthly payments)