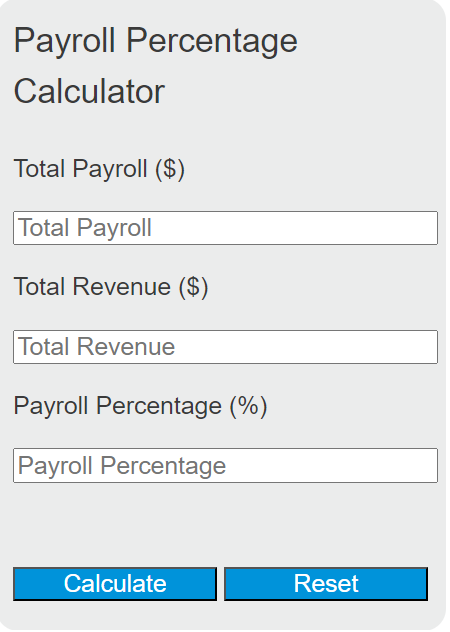

Enter the total payroll and total revenue into the calculator to determine the payroll percentage. This calculator helps in understanding the proportion of revenue that is allocated to payroll expenses.

Payroll Percentage Formula

The following formula is used to calculate the payroll percentage:

PP = (TP / TR) * 100

Variables:

- PP is the payroll percentage (%)

- TP is the total payroll ($)

- TR is the total revenue ($)

To calculate the payroll percentage, divide the total payroll by the total revenue and then multiply by 100 to get the percentage.

What is Payroll Percentage?

Payroll percentage is a financial metric that shows what portion of a company’s revenue is spent on payroll, including wages, salaries, and benefits. It is a key indicator of how labor-intensive a company is and can be used to assess the efficiency of labor costs in relation to revenue generation. A lower payroll percentage may indicate better labor cost management, while a higher percentage could suggest that payroll costs are a significant expense for the company.

How to Calculate Payroll Percentage?

The following steps outline how to calculate the Payroll Percentage.

- First, determine the total payroll (TP) in dollars.

- Next, determine the total revenue (TR) in dollars.

- Use the formula PP = (TP / TR) * 100.

- Finally, calculate the Payroll Percentage (PP).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Total Payroll (TP) = $120,000

Total Revenue (TR) = $600,000