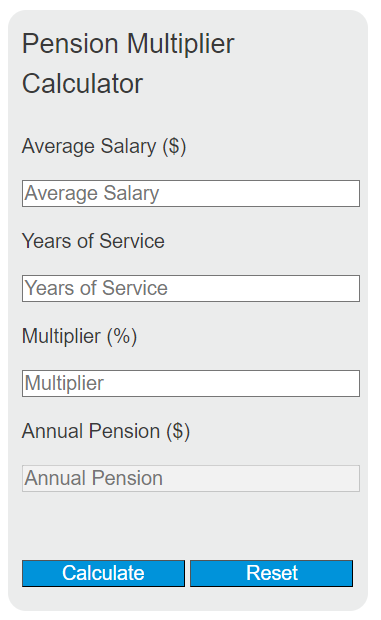

Enter the average salary, years of service, and the pension multiplier into the calculator to determine the annual pension amount. This calculator helps in estimating the pension benefits for retirement planning.

Pension Multiplier Formula

The following formula is used to calculate the annual pension amount.

P = AS * YS * (M / 100)

Variables:

- P is the annual pension amount ($)

- AS is the average salary ($)

- YS is the years of service

- M is the pension multiplier (%)

To calculate the annual pension amount, multiply the average salary by the years of service and then by the pension multiplier (expressed as a percentage).

What is a Pension Multiplier?

A pension multiplier is a factor used in retirement plans to calculate the annual pension benefits that an employee will receive upon retirement. It is typically a percentage that represents the portion of the employee’s average salary that they will receive for each year of service. The pension multiplier is an important aspect of defined benefit pension plans and helps determine the financial readiness of an individual for retirement.

How to Calculate Annual Pension?

The following steps outline how to calculate the annual pension amount.

- First, determine the average salary (AS) over a certain period, typically the last few years of employment.

- Next, determine the total years of service (YS).

- Next, determine the pension multiplier (M) as a percentage.

- Next, gather the formula from above = P = AS * YS * (M / 100).

- Finally, calculate the annual pension amount (P).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Average Salary (AS) = $50,000

Years of Service (YS) = 30 years

Pension Multiplier (M) = 2%