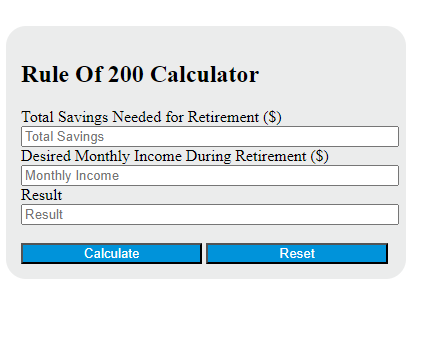

Enter the desired monthly income during retirement and the number 200 into the calculator to determine the total savings needed for retirement.

Rule Of 200 Formula

The following formula is used to calculate the amount of money needed to save for retirement using the Rule of 200.

S = I * 200

Variables:

- S is the total savings needed for retirement ($)

- I is the desired monthly income during retirement ($)

To calculate the total savings needed for retirement, multiply the desired monthly income during retirement by 200. This will give you the total amount of money you need to save to achieve your desired monthly income during retirement according to the Rule of 200.

What is a Rule Of 200?

The Rule of 200 is a financial guideline used to estimate the amount of money one needs to save for retirement. It suggests that for every $1 of monthly income you want to have in retirement, you need to have $200 saved. For example, if you want to have $1,000 per month during retirement, you would need to have $200,000 saved. This rule is a simplified way to plan for retirement and does not take into account other factors like inflation, investment returns, or other sources of income such as social security or pensions.

How to Calculate Rule Of 200?

The following steps outline how to calculate the Rule Of 200.

- First, determine the desired monthly income during retirement ($).

- Next, gather the formula from above = S = I * 200.

- Finally, calculate the total savings needed for retirement.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

desired monthly income during retirement ($) = 5000