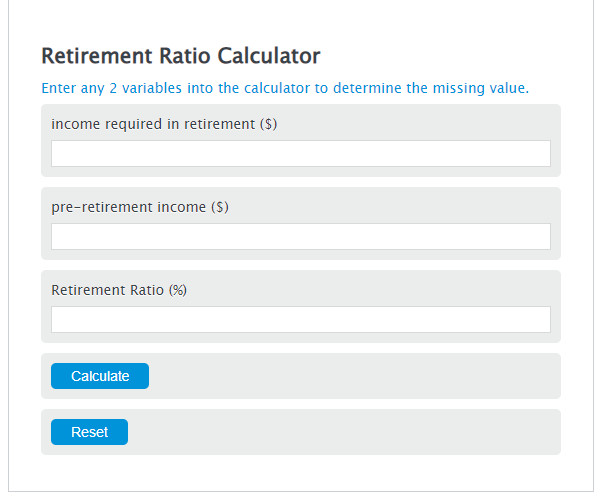

Enter the income required in retirement ($) and the pre-retirement income ($) into the Calculator. The calculator will evaluate the Retirement Ratio.

Retirement Ratio Formula

RR = RIR / PRI * 100

Variables:

- RR is the Retirement Ratio (%)

- RIR is the income required in retirement ($)

- PRI is the pre-retirement income ($)

To calculate the Retirement Ratio, divide the income required in retirement by the pre-retirement income.

How to Calculate Retirement Ratio?

The following steps outline how to calculate the Retirement Ratio.

- First, determine the income required in retirement ($).

- Next, determine the pre-retirement income ($).

- Next, gather the formula from above = RR = RIR / PRI * 100.

- Finally, calculate the Retirement Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

income required in retirement ($) = 5000

pre-retirement income ($) = 7000

Frequently Asked Questions

What is a good Retirement Ratio to aim for?

A good Retirement Ratio can vary based on individual circumstances, but many financial advisors suggest aiming for a ratio between 70-80%. This means your retirement income should be at least 70-80% of your pre-retirement income to maintain a similar lifestyle.

How can I increase my Retirement Ratio?

Increasing your Retirement Ratio can be achieved by boosting your retirement savings, reducing debt before retirement, investing wisely, and considering working longer or part-time in retirement to supplement income.

Does the Retirement Ratio take into account inflation?

No, the basic Retirement Ratio calculation does not directly account for inflation. It is important to consider the impact of inflation on both your pre-retirement income and required income in retirement when planning.