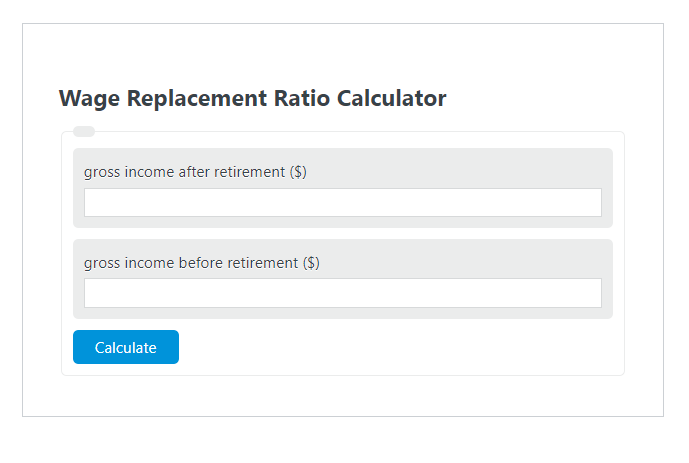

Enter the gross income after retirement ($) and the gross income before retirement ($) into the Wage Replacement Ratio Calculator. The calculator will evaluate and display the Wage Replacement Ratio.

- All Ratio Calculators

- Wages to Sales Ratio Calculator

- Compa Ratio Calculator

- Simple Ratio Calculator

Wage Replacement Ratio Formula

The following formula is used to calculate the Wage Replacement Ratio.

WPR = GIAR / GIBR *100

- Where WPR is the Wage Replacement Ratio (%)

- GIAR is the gross income after retirement ($)

- GIBR is the gross income before retirement ($)

To calculate the wage replacement ratio, divide the gross income after retirement by the gross income before retirement.

How to Calculate Wage Replacement Ratio?

The following example problems outline how to calculate Wage Replacement Ratio.

Example Problem #1:

- First, determine the gross income after retirement ($).

- The gross income after retirement ($) is given as: 3,000.

- Next, determine the gross income before retirement ($).

- The gross income before retirement ($) is provided as: 4,000.

- Finally, calculate the Wage Replacement Ratio using the equation above:

WPR = GIAR / GIBR *100

The values given above are inserted into the equation below and the solution is calculated:

WPR = 3,000 / 4,000 *100 = 75.00 (%)

FAQ

What is the importance of calculating the Wage Replacement Ratio?

The Wage Replacement Ratio (WPR) is crucial for retirement planning as it helps individuals understand how much of their pre-retirement income will be replaced by retirement income. This understanding aids in assessing whether the retirement savings and income will be sufficient to maintain their desired lifestyle after retirement.

How can one improve their Wage Replacement Ratio?

Improving the Wage Replacement Ratio can be achieved by increasing retirement savings, investing in retirement accounts, reducing debts before retirement, and considering additional income sources during retirement. Planning and adjusting these factors early can significantly impact the ratio positively.

Does the Wage Replacement Ratio vary by individual?

Yes, the Wage Replacement Ratio can vary significantly among individuals based on their income levels, lifestyle choices, debts, and retirement plans. Some may require a higher ratio to maintain their pre-retirement lifestyle, while others may need less. It’s a personalized metric that depends on individual circumstances and retirement goals.