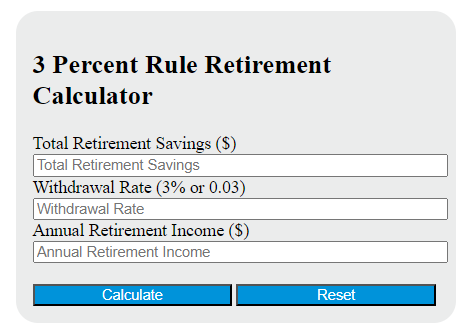

Enter the total retirement savings and withdrawal rate into the calculator to determine the annual retirement income.

3 Percent Rule Retirement Formula

The following formula is used to calculate the annual retirement income based on the 3 Percent Rule.

RI = P * r

Variables:

- RI is the annual retirement income ($)

- P is the total retirement savings ($)

- r is the withdrawal rate (3% or 0.03)

To calculate the annual retirement income, multiply the total retirement savings by the withdrawal rate. The result is the amount you can withdraw each year from your retirement savings to maintain a sustainable income.

What is a 3 Percent Rule Retirement?

The 3 Percent Rule for retirement is a guideline that suggests a retiree should withdraw no more than 3% of their retirement savings during the first year of retirement. Each subsequent year, the withdrawal amount is adjusted for inflation. This rule is designed to ensure that the retiree’s savings last for at least 30 years. It is a more conservative approach compared to the commonly referenced 4% rule.

How to Calculate 3 Percent Rule Retirement?

The following steps outline how to calculate the 3 Percent Rule Retirement.

- First, determine the total retirement savings ($).

- Next, determine the withdrawal rate (r) as a decimal (3% or 0.03).

- Next, gather the formula from above = RI = P * r.

- Finally, calculate the annual retirement income (RI).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total retirement savings ($) = 500,000

withdrawal rate (r) = 0.03