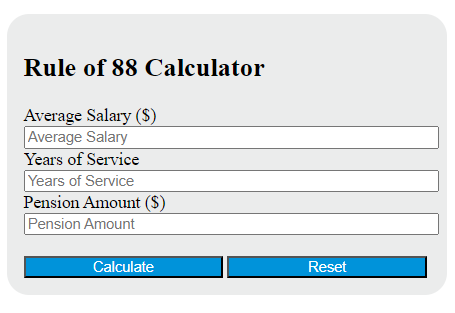

Enter the average salary and years of service to determine the pension amount under the rule of 88.

Rule Of 88 Formula

The following formula is used to calculate the Rule of 88.

R88 = (A * S) / 88

Variables:

- R88 is the pension amount under Rule of 88 ($)

- A is the average salary over the last 5 years of employment ($)

- S is the total years of service

To calculate the pension amount under Rule of 88, multiply the average salary over the last 5 years of employment by the total years of service. Then divide the result by 88.

What is a Rule Of 88?

The Rule of 88 is a retirement policy guideline used by some companies to determine when an employee is eligible for full retirement benefits. According to this rule, an employee can retire with full benefits when their age plus their years of service with the company equals 88. For example, if an employee is 60 years old and has worked for the company for 28 years, they would meet the Rule of 88 and be eligible for full retirement benefits.

How to Calculate Rule Of 88?

The following steps outline how to calculate the Rule of 88:

- First, determine the average salary over the last 5 years of employment ($).

- Next, determine the total years of service (S).

- Next, gather the formula from above = R88 = (A * S) / 88.

- Finally, calculate the Rule of 88.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

average salary over the last 5 years of employment ($) = 50000

total years of service (S) = 20