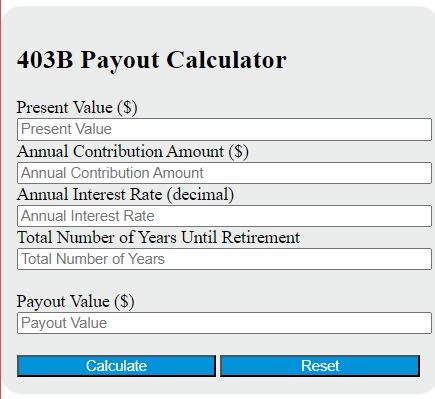

Enter the annual contribution amount, annual interest rate, and total number of years until retirement into the calculator to determine the 403B payout.

403B Payout Formula

The following formula is used to calculate the 403B payout.

PV = PMT * ((1 - (1 + r)^{-n}) / r)Variables:

- PV is the present value or the total amount in the 403B account at retirement ($)

- PMT is the annual contribution amount ($)

- r is the annual interest rate (decimal)

- n is the total number of years until retirement

To calculate the 403B payout, multiply the annual contribution amount by the result of 1 minus the annual interest rate plus 1 raised to the power of the negative total number of years until retirement. Divide this result by the annual interest rate.

What is a 403B Payout?

A 403B payout refers to the distribution of funds from a 403B retirement plan, which is typically offered to employees of public schools, tax-exempt organizations, and certain ministers. The payout can occur upon retirement, termination of employment, or on a set schedule while still employed, depending on the plan’s rules. The amount received is usually taxable as ordinary income, although some may qualify for special tax treatment.