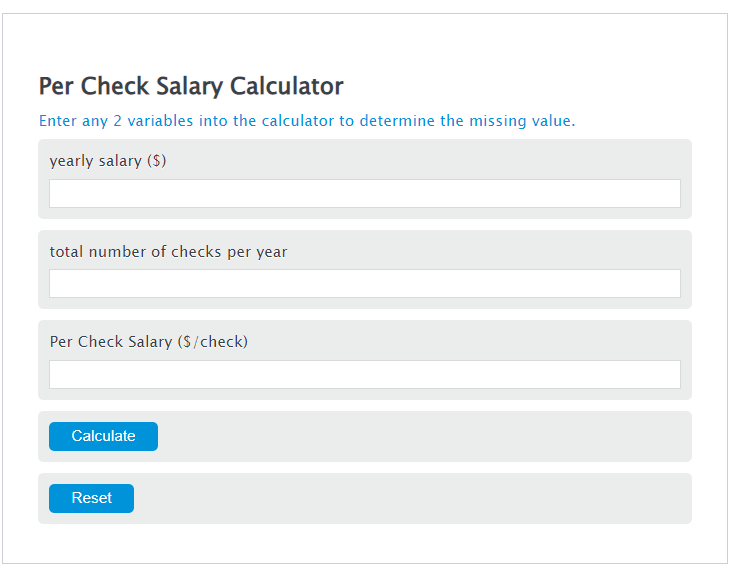

Enter the yearly salary ($) and the total number of checks per year into the Calculator. The calculator will evaluate the Per Check Salary.

Per Check Salary Formula

PCS = YS / C

Variables:

- PCS is the Per Check Salary ($/check)

- YS is the yearly salary ($)

- C is the total number of checks per year

To calculate Per Check Salary, divide the yearly salary by the number of checks per year.

How to Calculate Per Check Salary?

The following steps outline how to calculate the Per Check Salary.

- First, determine the yearly salary ($).

- Next, determine the total number of checks per year.

- Next, gather the formula from above = PCS = YS / C.

- Finally, calculate the Per Check Salary.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

yearly salary ($) = 50000

total number of checks per year = 52

FAQ

What factors can affect the amount on each paycheck besides the annual salary and number of paychecks?

Taxes, retirement contributions, health insurance premiums, and other deductions can affect the net amount received on each paycheck.

Is it better to have more or fewer paychecks per year?

This depends on personal preference and financial planning. More paychecks can help with budgeting and cash flow, while fewer paychecks can mean larger amounts that might be beneficial for managing larger expenses.

How can changes in the yearly salary affect the per check salary?

Any increase or decrease in the yearly salary will directly affect the per check salary, assuming the number of checks per year remains constant.

Can the per check salary calculation be used for both salaried and hourly employees?

Yes, for salaried employees, the yearly salary is predetermined, while for hourly employees, the yearly salary can be estimated based on the number of hours worked and the hourly rate.