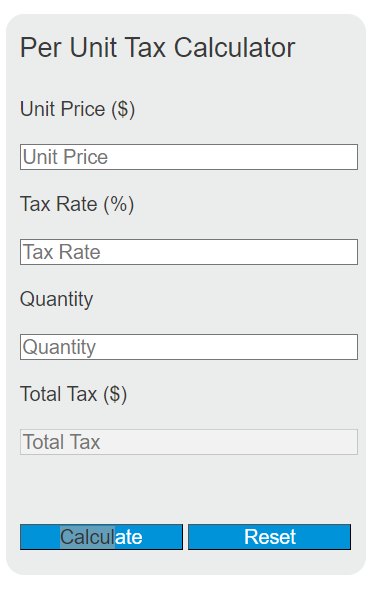

Enter the unit price, tax rate, and quantity into the calculator to determine the total tax for the items.

Per Unit Tax Formula

The following formula is used to calculate the total tax on a per unit basis.

TT = UP * TR * Q

Variables:

- TT is the total tax ($)

- UP is the unit price ($)

- TR is the tax rate (%)

- Q is the quantity of items

To calculate the total tax, multiply the unit price by the tax rate (in decimal form) and then by the quantity of items.

What is Per Unit Tax?

Per unit tax is the amount of tax that is levied on each individual unit of a product or service. This type of tax is often used in sales tax calculations where the tax is a percentage of the item’s price. The total tax is the sum of the per unit tax across all units purchased.

How to Calculate Per Unit Tax?

The following steps outline how to calculate the total tax on a per unit basis.

- First, determine the unit price (UP) in dollars.

- Next, determine the tax rate (TR) as a percentage.

- Next, determine the quantity (Q) of items.

- Next, gather the formula from above = TT = UP * TR * Q.

- Finally, calculate the total tax (TT) in dollars.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Unit Price (UP) = $50

Tax Rate (TR) = 8%

Quantity (Q) = 5