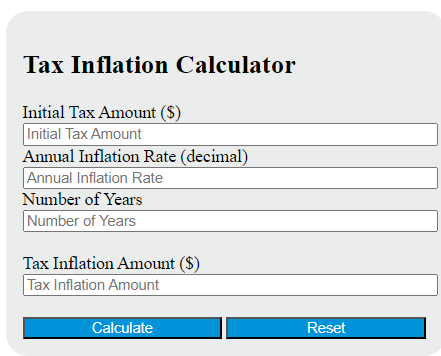

Enter the initial tax amount, annual inflation rate, and number of years into the calculator to determine the tax inflation amount. This calculator can also evaluate any of the variables given the others are known.

Tax Inflation Formula

The following formula is used to calculate the tax inflation.

TI = P * (1 + r)^n

Variables:

- TI is the tax inflation amount ($)

- P is the initial tax amount ($)

- r is the annual inflation rate (decimal)

- n is the number of years

To calculate the tax inflation, add 1 to the annual inflation rate. Raise this result to the power of the number of years. Multiply the initial tax amount by this result to get the tax inflation amount.

What is a Tax Inflation?

Tax inflation refers to the increase in tax liabilities due to the impact of inflation on income and wealth. This can occur when individuals are pushed into higher tax brackets due to increases in their nominal income, even though their real income (purchasing power) may remain the same or decrease. This is also known as “bracket creep”. Additionally, inflation can erode the value of certain tax deductions and credits, effectively increasing the tax burden.

How to Calculate Tax Inflation?

The following steps outline how to calculate Tax Inflation using the formula: TI = P * (1 + r)^n.

- First, determine the initial tax amount (P) ($).

- Next, determine the annual inflation rate (r) (decimal).

- Next, determine the number of years (n).

- Next, use the formula TI = P * (1 + r)^n to calculate the tax inflation amount (TI).

- Finally, calculate the Tax Inflation.

- After inserting the variables and calculating the result, check your answer with a calculator.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Initial tax amount (P) ($) = 500

Annual inflation rate (r) (decimal) = 0.03

Number of years (n) = 5