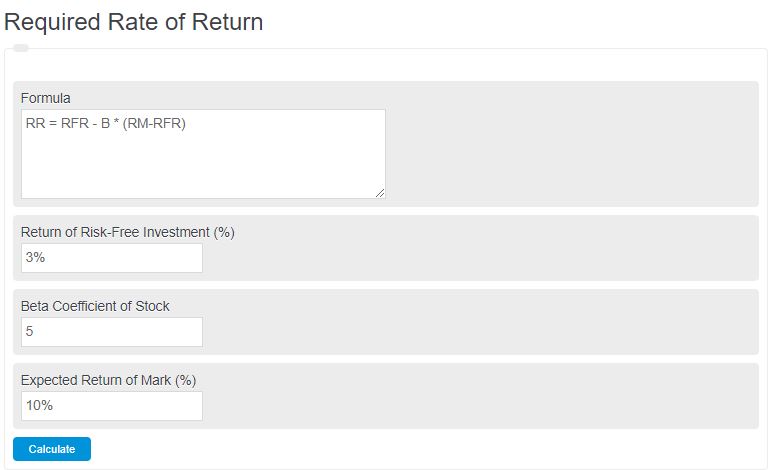

Enter the risk-free rate, beta coefficient of the stock, and the expected return from the market into the calculator to determine the required rate of return.

- ROI Calculator – Return on Investment

- High Yield Savings Account Calculator

- Expected Monetary Value Calculator

- Expected Rate of Return Calculator

Required Rate of Return

According to statistics, 90% of investors fail to regularly beat the market. So it’s needless to say that investing in any asset holds a lot of risks. To avoid this, you can use the required rate of return to assess an investment’s long-term performance.

The RRR helps companies compare one investment to another and determine if a project is worth it.

Let’s look at the required rate of return in greater detail.

What is the Required Rate of Return?

The required rate of return is the money a company will take in exchange for the risk of keeping a company’s stock. The higher the rate of return, the higher the risk.

Corporate finance uses the required rate of return to check the profit of investment proposals.

In addition, the required rate of return is used to determine how successful an initiative is compared to the expense of financing it.

How Do You Calculate The Required Rate of Return?

The Capital Asset Pricing Model (CAPM) can be used to estimate the Required Rate of Return Formula.

The CAPM model guides investors in assessing what kind of investment return they should expect for a risky investment.

The current inflation rate may impact the predicted return, but the rate isn’t modified to inflation.

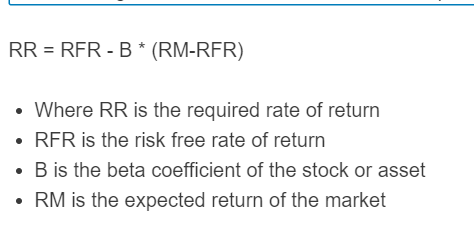

Required Rate of Return Formula

The following formula is used to calculate the required rate of return of an asset or stock.

RR = RFR + B * (RM-RFR)

- Where RR is the required rate of return

- RFR is the risk-free rate of return

- B is the beta coefficient of the stock or asset

- RM is the expected return of the market

To calculate the required rate of return, subtract the risk-free rate from the expected market return, multiply this by the beta coefficient, then add the result to the risk free rate.

What Is a Bad Rate of Return?

Investment assets with a poor return on investment result in money loss. In this case, if the expenses surpass the revenue, the investor will likely wind up with less than they spent.

Again, this causes a loss and is undoubtedly a nightmare for investors.

A decent rate of return is typically thought to be around 7% each year. So, if your return rate is lower than that, you may have an alarming return rate.

What Is a Real Rate of Return?

The real rate of return is the annual earnings that are adjusted for inflation. As a result, it depicts the real cost of funds to the investor.

Similarly, a rate of return that considers taxes or economic surges is referred to as the real rate.

Other estimates could result in a higher and more enticing rate of payoff. But, these don’t usually account for economic surges. They rarely consider what you will receive after taxes.

What Is The Required Rate of Return on Equity?

The required rate of return on equity is the profit a company needs on a project that’s funded with internal funds rather than borrowed money.

It’s also the estimated return necessary by a shareholder to keep its stock.

The rate of return indicates how much earnings you’ve gained from a particular project over a given timeframe, but the return on equity is a stock-specific measure that determines how much profits were made depending on the investors’ contributions.

What Is a Reasonable Rate of Return During Retirement?

In terms of saving for retirement, a rate of return of 6% to 7% is usually good enough, but this is merely an average that financial advisors recommend for estimating the returns.